The Role of Energy in Production

Chapter 13 from my forthcoming book Rebuilding Economics from the Top Down

Human society is energy blind. Like a fish in water, it takes for granted the existence of that without which it could not survive.

This is Chapter 13 from my forthcoming book Rebuilding Economics from the Top Down, which will be published by the Budapest Centre for Long-Term Sustainability and the Pallas Athéné Domus Meriti Foundation. I am serialising the book chapters here. A watermarked PDF of the manuscript is available to supporters.

Free subscribers: if Substack’s $5/month is too much, consider supporting me via Patreon for $1/month or $10/year discounted

Like so many other aspects of our blindness to the true nature of our society, the failure to comprehend the vital role that energy plays in enabling human civilisation to exist can be traced back to economists. But for once, the culprit is not a Neoclassical economist, but the person that most economists of all persuasions acknowledge as "the father of economics", Adam Smith.

Smith's mistake occurred in the very first sentence of The Wealth of Nations:

THE annual labour of every nation is the fund which originally supplies it with all the necessaries and conveniences of life which it annually consumes… (Smith 1776, p. 10)

The error is obvious when you compare this opening to the remarkably similar—in all but one respect—opening sentence to Richard Cantillon's An Essay on Economic Theory, which was published 21 years before Smith's second magnum opus:

Land is the source or matter from which all wealth is drawn; man's labor provides the form for its production, and wealth in itself is nothing but the food, conveniences, and pleasures of life. (Cantillon 1755, p. 21)

The critical difference between the two is Smith's substitution of the word "labour" for "land". By seeing labour, rather than land, as the source of the material wealth of civilisation, Smith set economics on a course that put it in conflict with the fundamental laws that govern the Universe: the "Laws of Thermodynamics".

These Laws of Physics were only fully developed a century after Cantillon and Smith's treatises on economics (Ulgiati and Bianciardi 2004, p. 108), so neither author can be faulted for not applying them, let alone for not using their terms—the word "energy" itself was only coined in 1802. So, it is only in hindsight that I can say that the foundational insight of the school of economic thought to which Cantillon belonged—the "Physiocrats"—was correct, while foundational proposition of the school that Smith established—Classical Economics, which largely ended with Marx—was wrong.

The Physiocratic insight was that wealth originates outside the economy, while Smith's proposition—which all subsequent schools of thought followed, including Marxian, Neoclassical76F and Post-Keynesian economics—was that wealth is created within the economy.

This is a fallacy because a closed system—in this case, the economy in isolation from the environment—cannot produce a surplus of outputs over inputs. In fact, the opposite applies: by the most famous and at the same time the most obtuse of the Laws, a closed system must degrade over time: it can only "produce" disorder in the aggregate, rather than order. By postulating that the economy, in isolation from the environment, could achieve growth, Smith, unwittingly, put economics in conflict with a Law that the great populariser of Einstein's Theory of General Relativity, Sir Arthur Eddington,77F described as the supreme law of Nature:

The law that entropy always increases—the second law of thermodynamics—holds, I think, the supreme position among the laws of Nature. If someone points out to you that your pet theory of the universe is in disagreement with Maxwell's equations—then so much the worse for Maxwell's equations. If it is found to be contradicted by observations—well, these experimentalists do bungle things sometimes. But if your theory is found to be against the second law of thermodynamics, I can give you no hope; there is nothing for it but to collapse in deepest humiliation. (Eddington 1928, p. 37)

Smith, writing a century before the Laws of Thermodynamics were developed, can't be criticised for making such a mistake. But economists today should not persist with models of production that violate the Laws of Thermodynamics.

In contrast, the Physiocratic argument that wealth originated in the land, and that human labour simply converted this from less to more useful forms for humanity's needs, was fundamentally correct in terms of these incontrovertible laws. Cantillon's fellow Physiocrat Anne Robert Jacques Turgot put their perspective best when he wrote—just two years before Smith—that the source of wealth is "this superfluity that nature accords him as a pure gift":

The Husbandman is the only person whose labour produces something over and above the wages of the labour. He is therefore the sole source of all wealth… The land pays him directly the price of his labour, independently of any other man or any agreement. Nature does not bargain with him to oblige him to content himself with what is absolutely necessary. What she grants is proportioned neither to his wants, nor to a contractual valuation of the price of his days of labour. It is the physical result of the fertility of the soil, and of the wisdom, far more than of the laboriousness, of the means which he has employed to render it fertile. As soon as the labour of the Husbandman produces more than his wants, he can, with this superfluity that nature accords him as a pure gift, over and above the wages of his toil, buy the labour of the other members of the society. The latter, in selling to him, gain only their livelihood, but the Husbandman gathers, beyond his subsistence, a wealth which is independent and disposable, which he has not bought and which he sells. He is, therefore, the sole source of the riches, which, by their circulation, animate all the labours of the society; because he is the only one whose labour produces over and above the wages of the labour. (Turgot 1774, p. 9. Boldface emphasis added)

There is so much wisdom in this paragraph, both in general and in terms of the Laws of Thermodynamics. The facts—for they are facts, though they were not known to be such in Turgot's time—that profit cannot be generated by work alone, but only by work that exploits what we find in Nature; that what exists in the Universe, independent of the actions of humans, is what enables our civilisation; that what we call a surplus is the gap between Nature's "pure gift" of energy and the energy humans put in to access it, and therefore, that "energy return on energy invested" is the foundation of civilisation. All these deductions were consistent with Laws that physicists did not fully develop for another century.

The Laws of Thermodynamics are amongst the most complex and difficult concepts in Physics, and I don't claim to be an expert on them, so that what follows is a very colloquial statement of them, and their implications for economics.78F

The First Law is that energy can neither be created nor destroyed: the amount of energy in the Universe (and in a closed system) is constant. The Second Law is that waste must be created as a consequence of using energy to perform work, unless that waste can be dumped into a reservoir whose temperature is absolute zero (zero Kelvin, or minus 273.15 degrees Celsius). The Third Law is that there is no such reservoir.79F

Georgescu-Roegen, the economist who pioneered the consideration of the Laws of Thermodynamics in economics, provided a definition of these Laws which neatly combined energy conservation and entropy:

In an isolated thermodynamic system, the available energy continuously and irrevocably degrades into an equal quantity of unavailable energy, so that the total energy remains constant while the unavailable energy keeps increasing up to a maximum. (Georgescu-Roegen 1993, p. 187)

The practical import of the First law for economics is that work cannot create a surplus: there cannot be "more outputs than inputs", and any economic theory that proposes otherwise is a fallacy. At best, we can take what exists in the Universe and convert it into a more useful form. The "surplus" in this sense is the gap between, as the Physiocrats put it, what Nature gives as a "pure gift", and "the labour of the Husbandman" needed to acquire that pure gift. In this sense, the Physiocrats developed a theory of production which was consistent with the First Law.

Their wisdom was, in some ways, a product of the relative lack of development of France compared to England at the time. In overwhelmingly agricultural France, they could see that production occurred in the first instance, not because of the labour of the farmer, but because of "this superfluity that nature accords him as a pure gift": plant one seed, and 1,000 seeds could grow from it. The quality of the land was by far the major determinant of production, and the human contribution was fundamentally due to the wisdom applied—the methods and machinery with which this pure gift was managed—rather than the quantity of labour expended. This insight was difficult for Smith to comprehend, given the far less agricultural and far more industrial nature of the Scottish economy.

The practical import of the Second and Third is that waste is not something which can be removed by "efficiencies" or "removing frictions" but is an inevitable by-product of performing work, and it can be minimized but never reduced to zero.80F Therefore, for a system to be able to produce a growing amount of output over time, there must be inputs from outside the system, and the system must dump waste outside itself. Though the Physiocrats did not codify this concept, they would have regarded as absurd any theory of production that postulated output with no input from Nature.

However, there was one critical flaw in the Physiocrats' vision: they did not realise that manufacturing also exploited Nature's free gift, in the form of ancient solar energy stored in fossil fuels. This flaw could have been corrected by Smith, had he observed that the "dark Satanic mills"81F of his industrialising Scotland were powered by coal (and waterwheels, charcoal, and peat), which was dug from the ground, and could therefore also be seen as part of "this superfluity that nature accords him as a pure gift"—even if it wasn't known at the time that coal was effectively preserved sunlight.

Instead, Smith rejected the core Physiocratic proposition that wealth originates in nature, and sited the source of wealth inside the economy, in the form of labour, and the growth of wealth as coming from the growing division of labour. This was a great step off the correct path of development for economics, and its deleterious effects are obvious when one compares Smith and Ricardo's struggles to understand where profit came from, to the ease with which Physiocrats explained it.

To the Physiocrats, profit was the gap between the energy inputs of "the Husbandman" and the energy he harvested from Nature's "pure gift": it is "a wealth which is independent and disposable, which he has not bought and which he sells" (Turgot 1774, p. 9. Emphasis added). But to Smith, profit was a violation of the rule that applied in "that early and rude state of society which precedes both the accumulation of stock and the appropriation of land" that "the proportion between the quantities of labour necessary for acquiring different objects seems to be the only circumstance which can afford any rule for exchanging them for one another" (Smith 1776, p. 65).

Once machinery and social classes developed, Smith declared, "something must be given for the profits of the undertaker of the work who hazards his stock in this adventure" (Smith 1776, p. 66. Emphasis added), but neither Smith nor Ricardo ever worked out how that "something" was either caused or calculated. This left it to Marx to declare that "surplus value" was the gap between the means of subsistence for workers ("labour value") and the work that workers performed ("labour power").

Marx was thus seen by his supporters as explaining profit as emanating from a surplus of outputs over inputs—which violates the First Law of Thermodynamics—and by his detractors as explaining profit by the exploitation of workers by capitalists—which enraged defenders of capitalism.82F Though there are many other issues in the decline of the Classical school of economics and the rise of the Neoclassical (Ekelund and Hébert 2002; Tabb 1999), and Neoclassical concepts can be traced back to Augustin Cournot (Cournot et al. 1897), Jean-Baptiste Say (Say 1821), Jeremy Bentham (Bentham and Bentham 1796) and even Aristotle (Aristotle, Pakaluk, and Aristotle 2020; 335-322 BCE), Marx's remaking of Classical economics into a critique of capitalism in 1867 (Marx 1867) helped empower the Neoclassical takeover of economics in the 1870s.

The Neoclassical argument that both labour and capital contributed to the increase in utility that characterised production, was, by postulating rising subjective utility in a closed system, as much in violation of the Laws of Thermodynamics as the objective surplus theory which it replaced. Worse, with no intrinsic consideration of waste—in fact, with a language that contemplates its absence in an ideal system with concepts such as "perfect competition", "perfect foresight", the absence of "frictions", and so on—it insults, if not actually violates, the Second Law.

This has led to an intellectual framework in which economics is fundamentally divorced from Nature. The economics textbooks of my youth at least spoke of four "factors of production"—Land, Labour, Capital and "Enterprise"—but textbooks today are shorn of the first and last. "Circular Flow Diagrams" in economics textbooks virtually never include any link from the natural environment to the economy.83

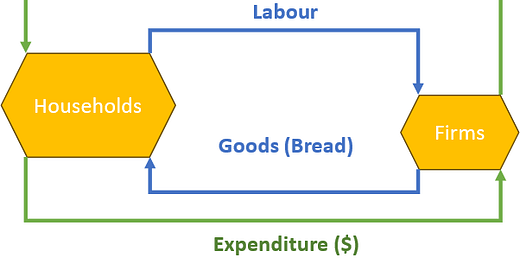

Mankiw's first "circular flow" drawing, reproduced here as Figure 60, takes the physical absurdity of Neoclassical economics to an even higher degree than usual, by imagining an economy in which a single output of bread is produced, but with no inputs of either capital or wheat, let alone energy. This is Mankiw's text for his drawing:

This figure illustrates the flows between firms and households in an economy that produces one good, bread, from one input, labor. The inner loop represents the flows of labor and bread: households sell their labor to firms, and the firms sell the bread they produce to households. The outer loop represents the corresponding flows of dollars: households pay the firms for the bread, and the firms pay wages and profit to the households. In this economy, GDP is both the total expenditure on bread and the total income from the production of bread. (Mankiw 2016, Figure 2-1 text, p. 19)

Figure 60: A reproduction of the first of the two "circular flow" diagrams in (Mankiw 2016, p. 19)

Labor in, and Goods out? This is not a model of production: it is a model of magic (Rowling 1997).

This blasé ignorance of the biophysical nature of production means that most Neoclassical economists are not even aware of the need to include energy in their models of production, let alone aware of the consequences of omitting it.

This ignorance of energy is apparent in the canonical text of Neoclassical economics—Marshall's Principles (Marshall 1890 [1920]). When Marshall spoke of "factors of production", he included numerous candidates, including raw materials, machinery and sources of energy, such as "horse or steam power" (Marshall 1890 [1920], p. 401). But when he spoke of energy itself, he exclusively meant the vitality and ingenuity of individuals, and not the essential input from the natural environment. Energy as defined by physicists in the Laws of Thermodynamics—"the capacity for doing mechanical work" or "the ability to drive a system transformation" (Ulgiati and Bianciardi 2004, p. 107)—never appeared in Marshall's work, even though the Laws had been settled two decades before he wrote.

A Production function without Energy

Similarly, three decades later, when Cobb and Douglas first attempted to build a mathematical model of production (Cobb and Douglas 1928), they did not include energy. They did state that "we should ultimately look forward toward including the third factor of natural resources in our equations and of seeing to what degree this modifies our conclusions" (Cobb and Douglas 1928, p. 164), but this was never done.

Their formula, based upon JB Clark's marginal productivity theory of production and income distribution (Clark 2001), was:

They fitted this formula to the index number data shown in Table 11, which they had laboriously assembled from very incomplete Census records, and an index-number series for GDP. From this they derived the parameters of their production function:

Though their function faced an initially unwelcoming reception (Biddle 2012), it was fortuitous for Cobb and Douglas—if not for economics itself—that its exponents matched those predicted by Clark's theory: the shares of labour and capital (¾ and ¼ respectively) in national income. Franklin Fisher later recounted a quip by Robert Solow that "had Douglas found labor's share to be 25 per cent and capital's 75 per cent instead of the other way around, we would not now be discussing aggregate production functions" (Fisher 1971, p. 305).

They also reported an extremely high correlation coefficient, not merely for Equation

, but for what they described as the data "with trends eliminated":

The coefficient of correlation between P

and P' with trends included is .97 and with trends eliminated is .94. (Cobb and Douglas 1928, p. 154)

This implied a high level of robustness for their result, but this is simply not true. The results and high correlations for the absolute value data are correct, but as Samuelson later observed, this was largely due to the collinearity of the data (Samuelson 1979, pp. 929). However, their stated results for the "trends eliminated" data are an artefact of their method of de-trending, which was to analyse the three-year moving average. When annual changes are used, the results are disastrous: the coefficient for is negative—and, for what it's worth, the R2 is also much lower (see Table 11).

Table 11: Parameter values and R2 from the Cobb-Douglas index data, and annual fractional change in the data

Economists, data & assumptions

Functions

Fitted values

R2

1. Cobb-Douglas original data

P = b. C.L1-

b=1.02, = 0.25

0.94

2. Cobb-Douglas change data

P/P=.C/C+(1-).L/L

0.66

The results are similarly bad when modern data is fitted. Table 12 shows for the results of regressions performed on the Penn World Tables data for the USA (see Table 13 in the Appendix) from 1950 till 2019 (Feenstra, Inklaar, and Timmer 2015). A fit of the CDPF to the aggregate data returns an of 1.24, which both heavily weights Capital's contribution to output, and gives Labour a negative weight. The annual rates of change data generates a value for which is less than 1, but also "wrong", in terms of the Neoclassical theory of income distribution: it attributes 71% of the change in output to Capital and only 29% to Labour. This may in fact be more realistic, but it conflicts with distribution of income data, and therefore with Neoclassical theory. As Solow said, had Cobb and Douglas returned results like these, Neoclassical economists "would not now be discussing aggregate production functions".

Table 12: CDPF fitted to PWT data for the USA from 1950 till 2019

Data

Functions

Fitted values

R2

3. PWT rgdpna, emp & rnna

P = b. C.L1-

b= 0.013, = 1.24

0.997

4. Annual change fraction PWT

P/P=.C/C+(1-).L/L

= 0.71

0.29

However, Neoclassical economists were saved the embarrassment of encountering these results by Solow's introduction of technical change into the CDPF.

Rescued by Solow's Residual

Solow intentions were laudable. As Samuelson observed, "assuming no technical progress in U.S. manufacturing for 1899-1922 did shock Schumpeter and should have done so… Reality commanded that technical change, or t itself, be put into the production function, so that it takes the Solow (1957) form Q=F(L,K;t)" (Samuelson 1979, pp. 924, 934).

However, to achieve his objective, Solow introduced two assumptions—that the exponents in the CDPF were in fact the marginal products of Labour and Capital, and that these were equivalent to income-share data:

The new wrinkle I want to describe is an elementary way of segregating variations in output per head due to technical change from those due to changes in the availability of capital per head. Naturally, every additional bit of information has its price. In this case the price consists of one new required time series, the share of labor or property in total income, and one new assumption, that factors are paid their marginal products. Since the former is probably more respectable than the other data I shall use, and since the latter is an assumption often made, the price may not be unreasonably high. (Solow 1957, p. 312. Emphasis added)

Of course, Neoclassical economists were more than willing to pay this "price", since it was to assume that their theories of production and of income distribution were both correct, and consistent with each other. They could then derive the contribution of change in technology from the difference between change in GDP and change in the two income-distribution-weighted "factors of production".

From this date on, the exponents in the CDPF were not derived from empirical data, but were simply assumed to be equal to the shares of Labour and Capital in income distribution data—1/3rd for Capital and 2/3rds for Labour (Solow 1957, Table 1, p. 315). Variation between changes in output and the weighted changes in inputs was attributed to "total factor productivity" and measured by "the Solow Residual". The fact that, in Solow's initial paper, 87.5% of growth was attributed to technical change, and only 12.5% to changes in the factor proportions of Labour and Capital, was only moderately embarrassing, compared to the regression results reported in Table 11 and Table 12.

Subsequently, Neoclassical economists have since simply assumed that their models of production and distribution are correct, and the coefficients of the CDPF have been transformed from flawed empirical findings to unquestioned theoretical assumptions.

All of this was without considering energy: to this day, the vast majority of Neoclassical models of production consider only Labour and Capital as inputs.84F But when energy was considered by some Neoclassicals, it was accorded the same treatment as Labour and Capital: its exponent was set by its share in GDP, and this was assumed to be equal to its marginal productivity.

The Power(lessness) of Energy?

Two of the very few Neoclassical papers that include energy in a production function and ascribe a numerical value to it85F are (Engström and Gars 2016) and (Bachmann et al. 2022). The former uses an exponent of 0.03 for Energy, and the latter of 0.04, in production functions of the form shown in Equation :

86F

Both made Solow's assumption that the share of energy in GDP is equal to the marginal productivity of Energy. This led Bachmann et al. to comment that:

Therefore, for example, a drop in energy supply of log E = -10% reduces production by logY = 0.04 x 0.1 = 0.004 =0.4% … [which] … "shows that production is quite insensitive to energy E as expected" (Bachmann et al. 2022, Appendix, p. 5. Emphasis added).

The data begs to differ.

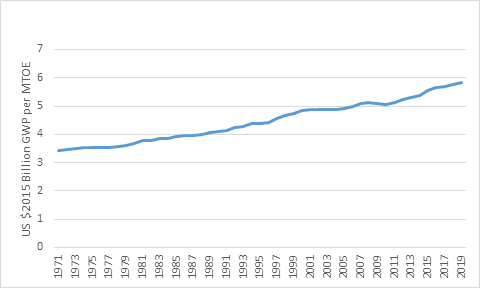

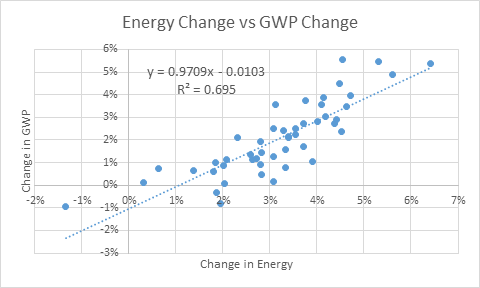

Figure 61 to Figure 64 show Gross World Product87F against Primary Energy Supply88F for the years 1971 till 2019 (see Table 16 in the Appendix). Far from production being "quite insensitive to energy", as assumed by Neoclassical economists, to a first order approximation, GDP is Energy. The empirically derived value of is 0.97, rather than the 0.03-0.04 value assumed by Neoclassical economists. Table 13 shows the coefficients for regressing GDP and the change in GDP |(Y/Y) against linear equations for Energy and the change in Energy (E/E).

Table 13: Regression of Energy against Gross World Product

Data

Functions

Fitted values

R2

5. OECD Energy & World Bank GWP

P=a+b.E

a=3510, b = 0.14

0.99

6. Annual change fraction

P/P=a+b.E/E

a=-0.01, b = 0.97

0.7

Figure 61: Gross World Product and Energy Consumption over time

Figure 62: Energy vs GWP

Figure 63: Ratio of GWP in US$2015 billion to Energy in MTOE from 1971 till 2019

This empirical data, as Bachmann et al. unintentionally show, is an effective refutation of the Neoclassical theories of production and income distribution, and confirmation of the Post-Keynesian theories.

Figure 64: Change in GWP and Change in Energy in Percent p.a.

Figure 65: Correlation of change in Energy and change in GWP in Percent p.a.

Bachmann et al. compare the polar opposites of the Cobb-Douglas and the Leontief in a CES production function, where the elasticity of substitution between inputs, equals 1 for Cobb-Douglas and 0 for Leontief. They correctly lay out the implications of the Leontief case, that:

Leontief production… implies that Y = E/ … and hence logY = log E … Therefore, if the elasticity of substitution is exactly zero, production Y drops one-for-one with energy supply E … Intuitively, the Leontief assumption means that energy is an extreme bottleneck in production: when energy supply falls by 10%, the same fraction 10% of the other factors of production X lose all their value (their marginal product drops to zero) and hence production Y falls by 10%. (Bachmann et al. 2022, Appendix, pp. 5-6. Emphasis added)

They plotted the theoretical relationships between energy input and GDP output for different values of the substitution parameter in their Figure 1, in which the Leontief function predicted a 1:1 fall in production for a fall in energy, and then rejected it because it led to nonsensical results in terms of Neoclassical theory:

Extreme scenarios with low elasticities of substitution and why Leontief production

at the macro level is nonsensical … The blue dashed line in Figure 1 showed that output falls one-for-one with energy supply in the Leontief case… the marginal product of energy jumps to 1/ [their exponent for energy] while the marginal product of other factors … falls to zero. If … factor prices equal marginal products, this then implies that similarly the price of energy jumps to 1/ and the prices of other factors a fall to zero… this then also implies that the expenditure share on energy jumps to 100% whereas the expenditure share on other factors falls to 0%. We consider these predictions to be economically nonsensical. (Bachmann et al. 2022, p. 15. Italicised emphasis added)

These predictions are nonsensical, but at the same time, the Leontief case fits the empirical data (which, following Solow's lead, they did not check). It is not the data which is false, but the assumption Bachmann et al. made that "factor prices equal marginal products". Therefore, this assumption must be wrong: wages, profits and the price of energy cannot be based upon the "marginal product" of labour, capital and energy respectively. The Neoclassical Cobb-Douglas model of production is false, and the Post-Keynesian Leontief model of production is correct. The question now remains as to why this is so.89F

From Empirical Regularity to the Role of Energy in Production

The Leontief Production Function began as an empirical regularity between GDP, however measured, and Capital, however measured. The ratio was relatively constant over time and showed no trend—see Figure 66 for Capital to Output ratios derived from the Penn World Tables database.

Figure 66: Capital to Output Ratios are reasonably constant over time

This led to the pragmatic Post-Keynesian school adopting the capital to output ratio as its "production function", with the justification that this relationship was found in the data, but with no real explanation as to why it was found. Leaving aside the minimum form in which the LPF is often expressed but seldom used, we have, as in the Goodwin model (Goodwin 1967, p. 54; Blatt 1983, p. 212):

Here v is the capital to output ratio. Applying dimensional analysis,90F in both the standard single commodity CDPF and LPF, Y and K are denominated in "Widgets per Year" and "Widgets" respectively—units of a hypothetical universal commodity that can be used for either investment or consumption:

For dimensional accuracy therefore, v must be a time constant denominated in Years:

The empirical regularity behind the LPF can now be explained by combining dimensional analysis with the aphorism first published in "A Note on the Role of Energy in Production" (Keen, Ayres, and Standish 2019), that:

labour without energy is a corpse, while capital without energy is a sculpture. (Keen, Ayres, and Standish 2019, p. 41):

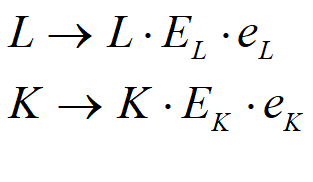

This suggests that the inputs of Labour and Capital assumed by both the CDPF and the LPF should be replaced by the energy inputs to both Labour and Capital, via the substitution shown in Equation :

Here respectively L and K stand for units of Labour and Capital,91F

EL and EK represent the energy consumed by a unit of Labour and a unit of Capital, and eL and eK are time constants (dimensioned by 1/Year) which represent the proportion of these inputs that are turned into useful work over a Year. This then suggests a way to derive the LPF from the dimensionality of the substitution proposed in Equation . The dimensions of K and L are units of Energy per Year:

Call this Q, denominated in units of Energy per Year, to distinguish it from Y, denominated in units of Widgets per Year:

Y is therefore equal to Q divided by EK:

This shows that the empirically derived capital to output ratio v is in fact the inverse of the proportion of energy inputs that machinery turns into useful work:

This provides a physical explanation for the empirical regularity on which the Post-Keynesian model of production is based: it is due to the role of machinery in turning energy—to date, predominantly fossil fuel energy—into useful work. Equation can therefore be used in place of Equation in Post-Keynesian models, and given the close relationship between GDP and Energy, to a first approximation, GDP is useful energy. The Leontief equation thus connects Post-Keynesian theory to the accurate insights of the Physiocrats, that Nature is the source of wealth, and that what human ingenuity does is enable the conversion of "this superfluity that nature accords him as a pure gift" (Turgot 1774, p. 9) into useful work.

Increased living standards over time can now be seen as being due to the increasing quantity of energy EK being consumed by (and turned into useful work by) the "representative machine" of any age. For a comparison of the most advanced motive-force machines of their day, energy per machine has risen from the roughly 30 tons of coal per day that Watt's steam engine consumed in 1776, to the 1,000 tonnes of methane consumed by SpaceX's Starship in a single launch lasting about ten minutes. This increasing energy consumption per head—and not the division of labour, nor the "marginal productivity" of Labour and Capital—is the true basis of the increase in the Wealth of Nations since Smith in 1776.92F Technological change since Watt's time till today is embodied in the machinery of the day, and the Leontief Production Function encapsulates this fact. The "Capital" in Watt's time is qualitatively different today's Capital, and that qualitative change can be measured by the quantitative growth in the energy-consumption and conversion capabilities of the representative machine.93F To take licence with Anderson's literary conclusion to "More is Different":

FITZGERALD: We are different from our ancestors.

HEMINGWAY: Yes, we have more energy. (Anderson 1972, p. 396)

The Post-Keynesian model is also consistent with the Laws of Thermodynamics, including the Second Law (which the Physiocrats did not anticipate) that doing work generates waste as well as desired output. With the capital to output ratio averaging 4 globally, and ranging between 3 and 5 for developed nations, the magnitude of eK is of the order of 0.2-0.33. This then quantifies the waste generated in production as being of the order of 0.67-0.8: humanity generates more waste than output. The constancy of the capital to output ratio, much criticised by Neoclassical economists, is in fact due to the impossibility of substituting any other input for energy, and intrinsic limits to the efficiency of conversion of energy into useful work given by the Second Law of Thermodynamics. This enables a LPF-based model of production to be linked to damage that production necessarily does to the capacity to extract energy from the biosphere by the dumping of waste into it.

The LPF can also be linked to resource depletion. The flow of energy into production is energy sourced from the environment, either in the form of non-renewable fossil fuels, nuclear isotopes, or hydro/solar/wind energy. The first two are necessarily depleted;94F the third is renewable, but as Simon Michaux emphasises, the minerals that are needed to capture this energy are not renewable (Michaux 2021b; Michaux 2021a).

The Neoclassical Cobb-Douglas Production Function, with its exponents assumed to be equal to the income shares of factor inputs, and also equal to the marginal product of those inputs, cannot be reconciled with energy data, or with the Laws of Thermodynamics, and is therefore wrong.

The Post-Keynesian Leontief Production Function, on the other hand, is both empirically accurate, and consistent with the Laws of Thermodynamics. Though the construction of a universal commodity in aggregate production functions has always been a convenience, the fact that GDP and Energy are so tightly coupled means that the LPF is a reasonable first approximation to reality. Solow's observation that "As long as we insist on practicing macroeconomics, we shall need aggregate relationships" (Solow 1957, p. 213) is correct, but the only aggregate production function that fits the bill is the Leontief Production Function.

Conclusion

Over time, Economics paid a huge price for Smith's at the time innocent substitution of labour for land as the ultimate source of wealth. As well as generating futile disputes over the source of value where both sides of the dispute—Marxists and Neoclassicals—were wrong, it has resulted in a modern discipline that is fundamentally divorced from the physical realities of production. This has had the ultimately disastrous outcome that economists who are ignorant of the physical nature of production, and its dependence upon energy and material inputs from and waste output to the environment, have advised humanity to ignore the ecological constraints to our civilisation—when they are equally ignorant of what those constraints are.

Appendix: Data Tables

Table 14: Cobb-Douglas Data set in Tables II, III & IV (Cobb and Douglas 1928, pp. 145, 148, 149) and annual rates of change

Table 15: Penn World Tables USA data (rgdpna, emp & rnna)

Table 16: GWP (US$ 2015 Billion)

and Primary Energy (Million Tons of Oil Equivalent)