The meme that is destroying Western civilisation Part VII

What government deficits do to government finances

In the last post (Substack; Patreon), I showed that a government Deficit increases the net worth of the private sector: if government spending exceeds taxation, then the non-bank private sector’s Asset of Deposit accounts rise, with no offsetting Liabilities. Therefore, a Deficit increases the net Equity of the private sector. But what does it do to the government?

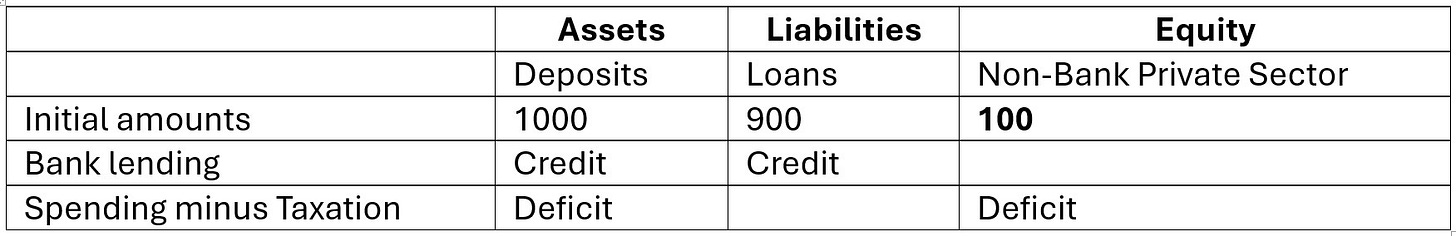

Double-entry bookkeeping helps you work this out. Table 1 and Table 2 show the Banking Sector’s and the Private Sector's positions, and they also show what’s not yet complete with the model. Both Loans and Deposits are shown twice, once as Assets and once as Liabilities, so their bookkeeping is complete. But Reserves are shown only once, as an Asset of the Banking Sector. So we need to add another table in which they are a Liability.

Table 1: Bank Lending and a Government Deficit from the banking sector's point of view

Table 2: Bank Lending and a Government Deficit from the non-bank private sector's point of view

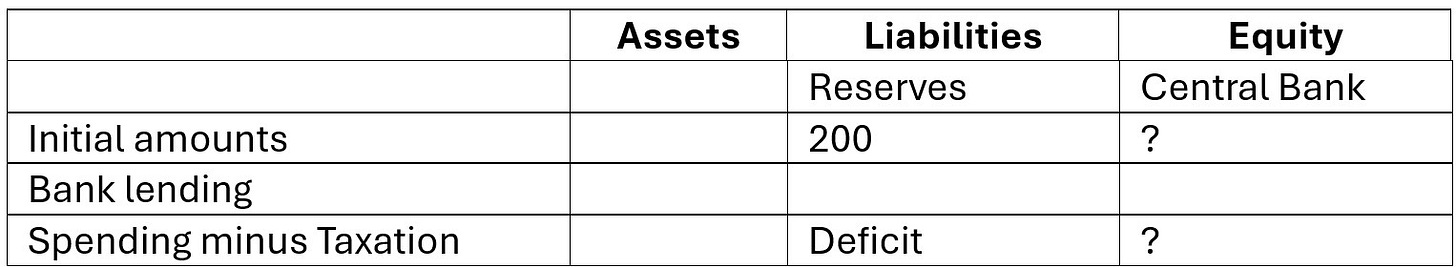

That’s the Central Bank’s Table, the first cut of which—without completing the double-entry—is shown in Table 3. To complete it, we have to add an entry on the “Spending minus Taxation” line that fulfils the accounting formula Assets minus Liabilities minus Equity equals Zero.

Table 3: The Central Bank's as yet incomplete table

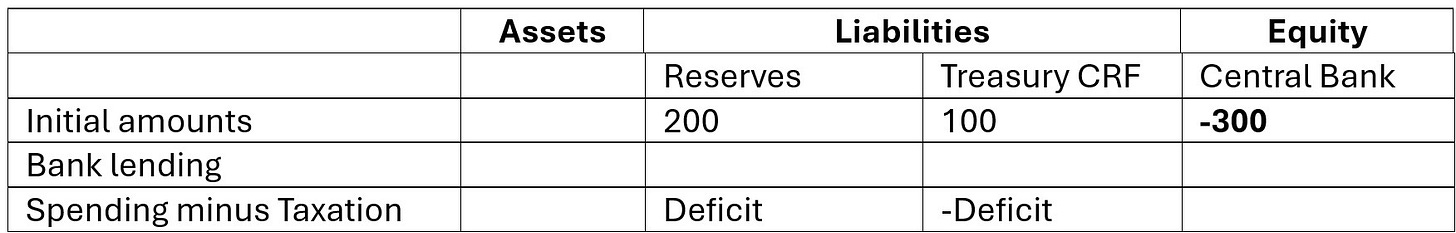

To do this, we need to add another Liability for the Central Bank: the Treasury’s account at the Central Bank, known as the “Consolidated Revenue Fund”. The funds that increase Reserves come out of this account, as shown in Table 4. Including its initial value in the system shows that the Central Bank’s Equity position is strongly negative—before I introduce Treasury Bond purchases in a subsequent post (Central Banks are in a different legal situation to private banks, and can function in negative equity—see the Bank of England paper “Accounting in central banks”).

Table 4: The Central Bank's table before considering bond sales

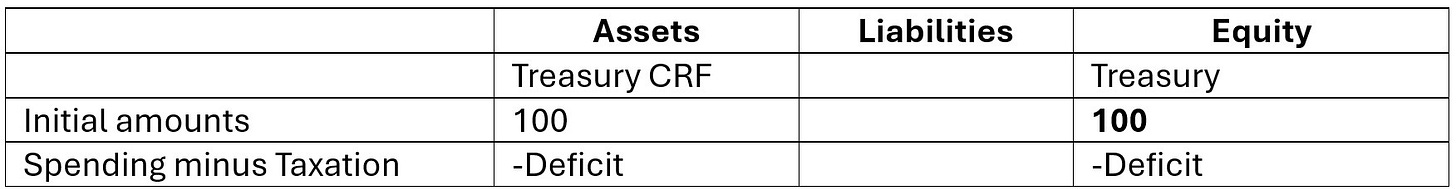

The model is still incomplete, because we’re showing the Treasury CRF as a Liability, but not yet as an Asset. This shows that we need one more table—for the Treasury itself. This is Table 5.

Table 5: The Treasury's table before considering bond sales

We can now explain how the government creates “fiat money”—as opposed to the “credit money” created by the banks. The Treasury goes into negative financial equity, which creates an identical magnitude of positive financial equity for the non-bank private sector, in the form of new money in private sector Deposit accounts. The fall in government financial equity—which we can call “reducing public saving”—causes an identical rise in the private sector’s financial equity, which we can call “increasing private saving”. The sum of the two is zero, so they’re like two sides of a seesaw: if one goes down, the other must go up by an identical amount.

Mainstream economists get this wrong because they don’t check the accounting, leading to statements like this in mainstream economics textbooks that befuddle the minds of our politicians and media:

the government finances the additional spending … by reducing public saving. With private saving unchanged, this government borrowing reduces national saving. (Mankiw 2016, p. 73)

Why don’t they study the accounting and correct this mistake? Because they don’t want to know! The belief that money is “neutral”—that it doesn’t affect real economic activity—is so ingrained into them, that acknowledging the real situation would undermine their entire paradigm.

This is why I’ve taken to describing the mainstream as not “Neoclassical Economists”, but “Ptolemaic Economists” (with apologies to Ptolemaic Astronomers, whose models of the Solar System were far more capable of predicting the future location of planets than Neoclassical economists are capable of predicting the future of the economy). They have a persuasive but structurally totally false model of the economy, and, just as Galileo found with Ptolemaic astronomers and his telescope, Neoclassical economists refuse to look down “the accounting telescope” to see what the actual structure of the economy is. As is so typical of humans, they would almost (?) rather die than change their beliefs.

But isn’t there something wrong about the government deliberately going into negative equity? Shouldn’t a responsible government always be in positive financial equity? I’ll consider this issue in the next post.

Free subscribers: if Substack’s $5 a month is too much, consider supporting me via Patreon for as little as $1/month or $10/year: https://www.patreon.com/ProfSteveKeen.

What happens to tax dollars when they reach the Internal Revenue Service? Are they actually utilized to fund the government and then the deficit is negated by creation of treasury bonds, or do taxes go "Poof" and then treasuries totaling both taxation and deficit are created?