I realized, while watching the semi-final at Roland Garros between Djokovic and Alcaraz, that I have lived a uniquely blessed and cursed life. My life has coincided with the best years of humanity, and I have played a unique but ultimately losing role in the two great crises of our age: the collapse of the speculative financial bubble of the 1990s-2010s, and now the impending—and imminent—crisis of climate change.

I was born in 1953, 8 years after the Nazis were defeated, when the United Nations was formed, during what was later termed "The Golden Age of Capitalism" (Marglin and Schor 1992). Yes, there have been wars, from the Vietnam War to Ukraine, horrors like Pol Pot, political crises like the Cuban Missile Crisis and economic ones like the Global Financial Crisis. But the generation before us had far worse crises—World Wars I and II, Nazi extermination camps, the Great Depression—and earlier Ages had theirs, from the American Civil War back to the collapse of Rome.

As a generation, we—yes, the "Baby Boomers"—had the best times in human history.

I've been more rarely blessed as well. I am a tennis tragic, who, had circumstances been different, would have tried his hand at professional tennis rather than academic economics. Instead, as a child, I modelled my game on the great Rod Laver, while as an adult, I had the sublime pleasure of watching Roger Federer, who did the same, play the most graceful and innovative tennis in the history of the sport.

Professionally, I've lived a blessed life as well. Most academic critics of economics are kept below the rank of Professor, but somehow I ended up as a Head of School (though to be frank, I wasn't a very good one: my fortes are teaching and research, not administration), and I "retired" with the honorary rank of Professor. Post-university, I'm living a relatively comfortable life thanks to my supporters on Patreon and Substack—something that most of my heterodox allies can only dream of.

I have therefore been uniquely blessed. But for each blessing there is a curse.

At the relatively trivial level of sport, while I enjoyed watching this contest, I'd much rather watch a replay of any Federer match than a live contest today. I've already witnessed the most gifted player and the greatest rivalries in the history of tennis. Tennis matches from here on will be a disappointment in comparison—as this match ultimately proved to be, when Alcaraz's incredible athleticism became his undoing, as his chronically cramped body ended his challenge to Djokovic.

At the far more significant level of the climate, I believe—based on my own research into the economics of climate change, and from reading hundreds of scientific papers on global warming—that we are at the beginning of the end for industrial civilisation.

The ever-improving living standards that Baby Boomers have taken for granted were actually propelled by the exploitation of the fossil fuel energy reserves on this planet, but paradoxically, energy, which is the critical factor in economic growth, is completely ignored by the conventional economic model of production (Keen 2020; Keen, Ayres, and Standish 2019). We have over-exploited these energy reserves, and ignored the carbon dioxide that their exploitation generates, so much that, this year, global temperatures hit 1.5℃ over pre-industrial levels on two occasions—with that second occasion being two days ago (June 8th—see Figure 1). We may very soon experience a sustained 1.5℃ over pre-industrial levels, which will wreak havoc on the production systems that, until now, have given us an ever-rising standard of living.

Figure 1:

https://twitter.com/EliotJacobson/status/1667165187894558721?s=20

That brings me to the uniquely personal curse of my life, which is the focus of this post. I have been Cassandra not once, but twice, and on two very different—though not unrelated—topics. Why me?

Cassandra Squared

For those who don't know their Greek mythology, Cassandra was the Trojan priestess who was fated to make accurate prophesies that were never believed.

I have now been a Cassandra on two occasions: the "Global Financial Crisis" (GFC—or "Great Recession" as Americans tend to call it) of 2007-10, and—though I'm very late to the game, and far from the most important Cassandra—the possible destruction of our industrial civilisation by climate change.

Cassandra Mark I: The Global Financial Crisis

My oracular capability on the GFC came from both understanding Hyman Minsky's "Financial Instability Hypothesis" (Minsky 1978), and being able, as Minsky himself was not, to put it into a mathematical format (Keen 1995). That led to the model shown in Figure 2, which showed a decline in economic volatility as private rose, followed by a rise in volatility and finally a crisis as debt overwhelmed the economy. The striking and unexpected decline in volatility before the crisis (Minsky did say that "stability is destabilizing", but he was thinking in terms of one single cycle, rather than the many-cycles process illustrated in Figure 2) led to the conclusion to my 1995 paper, that:

this vision of a capitalist economy with finance requires us to go beyond that habit of mind that Keynes described so well, the excessive reliance on the (stable) recent past as a guide to the future. The chaotic dynamics explored in this paper should warn us against accepting a period of relative tranquillity in a capitalist economy as anything other than a lull before the storm. (Keen 1995, p. 634. Emphasis added)

Figure 2: My model of Minsky's FIH in Minsky, showing the impact of rising debt and negative credit

That hypothetical warning turned real when, in December 2005, I saw the level of private debt in Australia and America hit levels never seen since WWII, while the ratio of private debt to GDP was rising exponentially in both countries. And, tellingly, the period prior to the crisis that I then believed was inevitable was marked by declining volatility in the business cycle—something that my model predicted would precede a crisis.

I established my first (and now largely dormant) blog http://www.debtdeflation.com/blogs/ and started to warn publicly about the dangers of rising private debt from December of 2005. In May 2007, I literally described myself as a Cassandra when I gave a succinct summary of why I expected a recession—and a severe one:

At some point, the debt to GDP ratio must stabilise--and on past trends, it won't stop simply at stabilising. When that inevitable reversal of the unsustainable occurs, we will have a recession.

Figure 3: My Cassandra profile from 2007, before the Global Financial Crisis began

The recession duly arrived in the USA, and as Figure 4 shows, negative credit was the dominant factor behind it. Credit rose to be the equivalent of 15% of GDP—its highest level in history—and then plunged to reach minus 5% of GDP in 2009. Since, contra Neoclassical theory, credit is a component of aggregate demand and income, and by far the most volatile component, the economy moved in opposing lock step with credit, booming as it rose, and collapsing as it fell and turned negative.

Figure 4: Private Debt and Credit in the USA 1990-2010

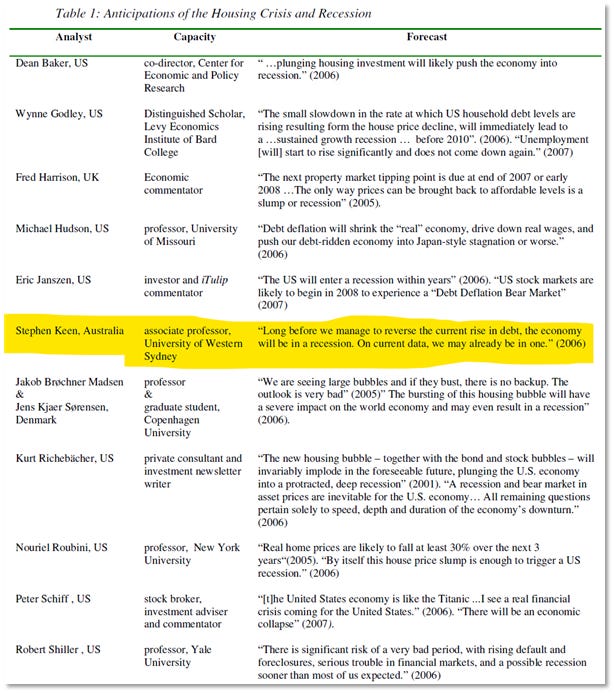

After the crisis, the Dutch economist Dirk Bezemer looked through economic literature to identify people who could legitimately claim to have predicted it, and I turned up as one of twelve Cassandras—see Figure 5.

Figure 5: Bezemer's list of the dozen economists who warned of the GFC before it happened

I wasn't the first Cassandra though. Dirk's table implies that Fred Harrison was the first, but if you check the academic literature, Wynne Godley deserves that accolade, for the warning he published jointly with Randall Wray in 2000, entitled "Is Goldilocks Doomed?" (Godley and Wray 2000). My warning emanated from my interpretation of Minsky, and the role of credit in the economy, whereas Godley and Wray used the sectoral balances approach that Wynne pioneered, and which is the foundation of "Modern Monetary Theory":

It has been widely recognized that there are two black spots that blemish the appearance of our Goldilocks economy: low household saving (which has actually fallen below zero) and the burgeoning trade deficit. However, commentators have not noted so clearly that public sector surpluses and international current account deficits require domestic private sector deficits. Once this is understood, it will become clear that Goldilocks is doomed. (Godley and Wray 2000, pp. 201-202. Emphasis added)

Of course, we were all ignored until after the crisis—and then we were only acknowledged by the underground of economics, rather than the mainstream. We therefore never cut through into public debate—though the one positive legacy of those ignored warnings may well be the rise of MMT.

Cassandra Mark II: Economists and the Global Warming Crisis

The common theme between being an ignored prophet on financial crises, and being an ignored prophet on climate change, is that the key people who claimed there was not going to be a financial crisis, or an ecological crisis, were economists.

In the case of the GFC, the inability of economists to see that a crisis was imminent emanated from their shared ignorance of the role of money—and in particular, credit—in the economy. With their eyes blindfolded to this critical factor in macroeconomics, there was no way to see the danger ahead, unless one stepped outside the Neoclassical canon. That's why only one Neoclassical name—Robert Shiller, the author of Irrational Exuberance (Shiller 2005)—turns up in Bezemer's list.

In the case of the looming ecological crisis, economists also have a shared ignorance on the role of energy in production. But there was no intrinsic reason why their empirical work on climate change had to be as bad as that done by Nordhaus. The facts that he could assume that a roof—or in his words, a "carefully controlled environment"—meant that 87% "of United States national output is produced … in sectors that are negligibly affected by climate change" (Nordhaus 1991, p. 930), and that his initial estimate was that 3℃ of warming would reduce future GDP by no more than 2% (Nordhaus 1991, p. 933), betrayed a complete lack of understanding of what climate actually means:

The low, medium, and high damage curves are, respectively, (i) economic costs actually identified in this study (¼% of total output), (ii) the costs raised to 1 percentage point to allow for a significant amount of potential unmeasured damage, and (iii) an estimate of 2% to allow for maximum plausible damages. (Nordhaus 1991, p. 934. Emphasis added)

There was no innate reason why economic referees would approve the publication of a paper as full of ignorant assumptions as Nordhaus's paper was, except that the referees themselves were not experts on climate change, and were in no position to sensibly evaluate his claims. Since Nordhaus's nonsense is the foundation of all the empirical trivialisation of the dangers of climate change, he has played a pivotal role in blinding us to the dangers that scientists have been warning about for over half a century now.

As the only critic of Nordhaus's to focus on the absurdity of his and his followers' empirical estimates, I have joined the scientists Jim Hansen (Hansen et al. 2006; Hansen et al. 2022), Tim Lenton (Lenton et al. 2008; Lenton et al. 2019; Xu et al. 2020), Will Steffen (Steffen et al. 2018) and many others as a Cassandra on climate change. They are the experts on climate change, and why it is so dangerous, not me. But I have helped explain one thing they could not: why were their warnings being ignored?

Yes., it was because the fossil fuel industry ran a disinformation campaign, so that the gravy train on which they rode could continue until the end. But the fossil fuel industry, and shrills like Bjorn Lomborg (Lomborg 2020), could not have been as effective if they were not able to rely upon predictions by economists that the economic consequences of climate change would be slight. If fossil fuel companies are the armies fighting against meaningful action on climate change, then economists are their arms dealers.

The Trojan Horse Arrives?

In mythology, and possibly even history, Cassandra's key prediction was to "Beware of Greeks bearing gifts": the Trojan Horse. That ignored warning led to the sacking of Troy. Well over half a century of climate change warnings have been ignored to date, and the data for this year is making many climate scientists fearful that the Climate Trojan Horse has finally arrived. The current data for climate anomalies is simply off the scale compared to any previous year. The following graphs—sourced from Climate Change Twitter—emphasise just how scarily unique 2023 is proving to be.

Everything Everywhere, All At Once

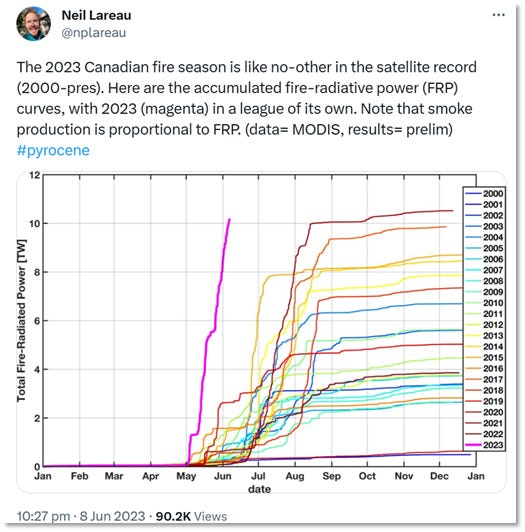

The most visible impact of climate change so far this year has been the smoke from Canadian wildfires which made the air in New York hazardous. Neil Lareau, who is Professor of Atmospheric Sciences at the University of Nevada Reno, posted this chart showing the total energy output from Canadian wildfires over time. With 2 months of summer still to go, 2023 has already exceeded the level of all bar one previous year.

Figure 6: https://twitter.com/nplareau/status/1666919867864469504?s=20

The global temperature anomaly today (June 10th 2023) would occur only once every 3,500 years, if temperature variations were simply a random process.

Figure 7: https://twitter.com/EliotJacobson/status/1667198969347440641?s=20

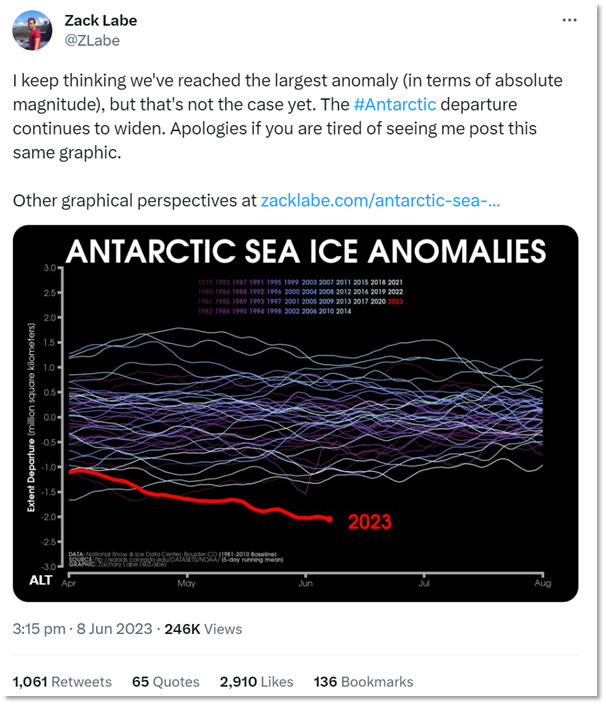

Antarctic sea ice is also way, way below all previous lows.

Figure 8: https://twitter.com/ZLabe/status/1666811217753833484?s=20

The average sea temperature between the Poles is a once-every-two-centuries anomaly.

Figure 9: https://twitter.com/EliotJacobson/status/1666825025427750912?s=20

All these divergences are not only unprecedented in the historical record, they are all still growing, and at alarming rates. Climate scientists are frankly scared by the data they're seeing in 2023, but like me, most of them are also resigned to being ignored. Being a Cassandra is no fun at all.

Godley, Wynne, and L. Randall Wray. 2000. 'Is Goldilocks Doomed?', Journal of Economic Issues, 34: 201-06.

Hansen, James, Makiko Sato, Reto Ruedy, Ken Lo, David W. Lea, and Martin Medina-Elizade. 2006. 'Global temperature change', Proceedings of the National Academy of Sciences, 103: 14288-93.

Hansen, James, Makiko Sato, Leon Simons, Larissa S. Nazarenko, Karina von Schuckmann, and Norman G. Loeb. 2022. 'Global warming in the pipeline', arXiv pre-print server.

Keen, Steve. 1995. 'Finance and Economic Breakdown: Modeling Minsky's 'Financial Instability Hypothesis.'', Journal of Post Keynesian Economics, 17: 607-35.

———. 2020. 'The appallingly bad neoclassical economics of climate change', Globalizations: 1-29.

Keen, Steve, Robert U. Ayres, and Russell Standish. 2019. 'A Note on the Role of Energy in Production', Ecological Economics, 157: 40-46.

Lenton, Timothy M., Hermann Held, Elmar Kriegler, Jim W. Hall, Wolfgang Lucht, Stefan Rahmstorf, and Hans Joachim Schellnhuber. 2008. 'Tipping elements in the Earth's climate system', Proceedings of the National Academy of Sciences, 105: 1786-93.

Lenton, Timothy, Johan Rockström, Owen Gaffney, Stefan Rahmstorf, Katherine Richardson, Will Steffen, and Hans Schellnhuber. 2019. 'Climate tipping points - too risky to bet against', Nature, 575: 592-95.

Lomborg, Bjorn. 2020. 'Welfare in the 21st century: Increasing development, reducing inequality, the impact of climate change, and the cost of climate policies', Technological Forecasting and Social Change, 156: 119981.

Marglin, Stephen A., and Juliet B. Schor. 1992. Golden Age of Capitalism (Clarendon Press Oxford: Oxford, UK).

Minsky, Hyman P. 1978. 'The Financial Instability Hypothesis: A Restatement', Thames Papers in Political Economy, Autumn 1978.

Nordhaus, William D. 1991. 'To Slow or Not to Slow: The Economics of The Greenhouse Effect', The Economic Journal, 101: 920-37.

Shiller, Robert J. 2005. Irrational exuberance (Broadway Books: Princeton, N.J.).

Steffen, Will, Johan Rockström, Katherine Richardson, Timothy M. Lenton, Carl Folke, Diana Liverman, Colin P. Summerhayes, Anthony D. Barnosky, Sarah E. Cornell, Michel Crucifix, Jonathan F. Donges, Ingo Fetzer, Steven J. Lade, Marten Scheffer, Ricarda Winkelmann, and Hans Joachim Schellnhuber. 2018. 'Trajectories of the Earth System in the Anthropocene', Proceedings of the National Academy of Sciences, 115: 8252-59.

Xu, Chi, Timothy A. Kohler, Timothy M. Lenton, Jens-Christian Svenning, and Marten Scheffer. 2020. 'Future of the human climate niche', Proceedings of the National Academy of Sciences, 117: 11350-55.

"stability is destabilizing"

This statement, being a wisdom insight by virtue of its observation of either the dangers or resolving advantages of contemplating complete conceptual opposition, should have been your clue to investigate the new monetary paradigm concept which destroys the supposed inflationary nature of the quantity theory of money with the insight that "monetary gifting strategically implemented with equal accounting entries at retail sale of a 50% discount to the consumer all of which is rebated back to the merchant granting it to the consumer...implements beneficial macro-economic deflation for both individual and commercial agents. Conceptual analysis has way more potential for good than mere system's analysis.

You're completely right regarding neo-liberal idiocy on energy and climate change, but lets not give up on technological innovation quite yet as off planeting solar energy and micro waving it back to earth has promise as well as this research: https://www.advancedsciencenews.com/a-man-made-cloud-device-generates-electricity-from-thin-air/

Folks might like to check out Roger Pielke Jr. at The Honest Broker for some cogent climate science and climate policy analysis.