The meme that is destroying Western civilisation Part V

How private banks create money and leave non-banks in negative financial equity

In the last post in this series (Substack; Patreon), I asserted that mainstream economists don’t understand how money is created, because they want to believe that money doesn’t really matter. They’re profoundly wrong on this, but they have no interest in knowing what’s right: they just want to ignore money—and banks, and private debt—when they build economic models.

So, to understand how money is actually created, you have to throw your economics textbooks away, and learn double-entry bookkeeping.

Most people’s reactions to that are “Oh no, not boring accounting!” I’ll grant that accountants would be a lot cheaper if they charged by the joke rather than by the hour. But looking at the double-entry bookkeeping of money today is like looking down Galileo’s telescope 500 years ago: it shows you a view of the universe that, for most people, is a life-changing revelation.

The basics of double-entry bookkeeping are that:

· Your financial claims on other people are your Assets, other people’s financial claims on you are your Liabilities, and the difference between the two is your Equity (or net financial worth); and

· You record all transactions twice, so that each transaction obeys the formula Assets minus Liabilities minus Equity equals Zero.

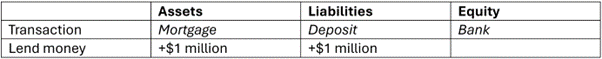

I’ll start with how banks create money in this post. Consider a bank making a mortgage loan of $1 million to a customer. Table 1 shows the double-entry bookkeeping from the Bank’s point of view.

Table 1: Bank money creation via a single housing loan, from the banking sector's point of view

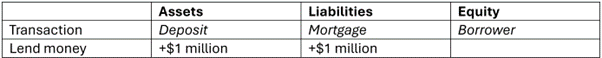

From the customer’s point of view, the sums are swapped: what was an Asset for the bank is a Liability for the customer, and vice versa, as

Table 2: Bank money creation from the borrower’s point of view

To use the same concept for the entire economy, I replace “Mortgage” with “Loans”, use the plural of Deposit and Bank, and, rather than using numbers (“+$1 million”), I use the word “Credit” to represent the annual change in Loans. This can be negative, if people in the aggregate are paying off debt rather than taking on new debt, but in a growing economy, this will normally be positive.

I also add one more detail: the initial amounts in each of the three accounts. An essential detail here is that banks must be in positive equity: any bank whose short-term Liabilities exceeds its short-term Assets is bankrupt. So, using hypothetical numbers, the Banking Sector has Assets of $1 trillion and Liabilities of $900 billion, and is in positive equity to the tune of $100 billion.

Table 3: Bank money creation at the macroeconomic level, from the Banking Sector’s point of view

The situation is reversed for the Private non-banks—households and firms in this hypothetical example are in negative equity, to the tune of minus $100 billion.

Table 4: Bank money creation at the macroeconomic level, from the non-Bank Private Sector’s point of view

That’s the first revelation from the monetary telescope of double-entry bookkeeping: since the sum of all financial assets and liabilities is necessarily zero, in an economy with no government, the non-bank private sector is necessarily in negative financial equity.

Though the non-bank private sector also owns non-financial assets—things like houses and factories that are assets to their owners and liabilities to no-one—it’s still an uncomfortable situation for the non-bank private sector to be in negative financial equity.

Is there a solution? Yes: it’s called fiat money, and I’ll explain how it’s created in the next post in this series.

Free subscribers: if Substack’s $5 a month is too much, consider supporting me via Patreon for as little as $1/month or $10/year: https://www.patreon.com/ProfSteveKeen.

Money is a social relation. It is a generalised claim on a part of the product of the economic domain of the authority which supports it. Being legal tender means that this claim is supported by property laws, contract laws etc.

The banks money making trick is that it can take an IOU (a loan contract) and turn it into a bank asset - and - corresponding to the bank asset, create a deposit of legal tender.

Any repayments on the loan then writes down the value of the bank asset and disappears.

Money then also has a scope (or domain) which is defined by the extent of the reach of the authority which supports it. Within this domain money is not a commodity, but the unit of account in which commodities express their relative value.

Money only becomes a commodity when it leaves its domain and confronts money from other domains.