George Selgin announced some weeks back that he planned to write a definitive critique of the argument that “banks do not simply act as intermediaries, lending out deposits that savers place with them” (McLeay, Radia, and Thomas 2014, p. 14)—while also taking a swipe at me:

In his paper, entitled “Banks Are Intermediaries of Loanable Funds” (Selgin 2024. Emphasis in original), he:

defends the supposedly naïve “Intermediation” theory of banking against its lately de rigueur “Thin Air” rival. It holds that the Intermediary theory of banking comes much closer to describing the workings of actual banking systems than the Thin Air alternative. (Selgin 2024#, p. 1)

I’m pleased that George made this attempt, because the usual approach of defenders of the mainstream view—that banks are “financial intermediaries” which must themselves borrow before they can lend—is to simply ignore or disparage the alternative, rather than to seriously engage with it.

The alternative view—that banks do not need to borrow in order to lend—has been around for over a century, as Selgin acknowledges. But since it was the province of non-mainstream economists like Joseph Schumpeter (Schumpeter 1934) and Irving Fisher (Fisher 1933) in the 1930s, critics of monetarism like Alan Holmes in the 1960s (Holmes 1969), and Post-Keynesian economists since then (Moore 1979; Minsky, Nell, and Semmler 1991; Jarsulic 1989; Minsky 1977, 1975; Minsky, Okun, and Warburton 1963; Palley 1991; Fullwiler 2013; Godley 2004; Graziani 2003; Dow 1997), it was easy for mainstream economists to ignore it.

That changed in 2014, when the Bank of England published “Money creation in the modern economy” in 2014 (McLeay, Radia, and Thomas 2014) and emphatically sided with the alternative rather than the conventional view.

This was followed up by a DSGE-based modelling paper co-authored by Michael Kumhof, who is Senior Research Advisor to the Research Hub of the Bank of England:

However, Neoclassical economists have continued to ignore the “Thin Air” approach, as Selgin calls it. I have only located one mainstream paper that engaged with “Money creation in the modern economy”. Entitled Loanable Funds vs Money Creation in Banking: A Benchmark Result (Faure and Gersbach 2022a), it has a truly astounding abstract:

We establish a benchmark result for the relationship between the loanable-funds and the money-creation approach to banking. In particular, we show that both processes yield the same allocations when there is no uncertainty. In such cases, using the much simpler loanable-funds approach as a shortcut does not imply any loss of generality. (Faure and Gersbach 2022a, p. 107. Emphasis added)

Only Neoclassical economists could put the words “when there is no uncertainty” and “does not imply any loss of generality” in the same paragraph.

Selgin engages rather more seriously with the alternative. Rather than arguing that the Loanable Funds” model is simpler “when there is no uncertainty”, he attempts to show that banks still need to borrow, even though it is true that banks can create money. He uses Jakab and Kumhof’s paper as his reference point for why economics should stick with the conventional “Loanable Funds” model—hence his title, which is a riff on theirs:

Selgin does not deny that banks create money when they lend, but he asserts that banks still need to borrow in order to lend.

He states his objective rather tentatively:

I hope to show that … as … Tobin wrote … “It would seem well to return to the nineteenth century doctrine that banks receive money from one set of people and lend it to another” (ibid., 35).

Before I show why he fails, I want to clarify what it means to say that banks create money “out of nothing” (Schumpeter 1934, p. 73). It definitely does not mean that banks create money via magic. What it means instead is that there is no other account from which a bank loan is financed, whereas there is such an account for a non-bank loan.

Non-Bank versus Bank Lending

If you make a loan from your bank account to a friend’s bank account, your account goes down and theirs goes up by precisely the same amount. Equally, if you borrow from a non-bank financial institution (such as a building society), their account at a bank falls, and yours rises, by precisely the same amount. In this case of non-bank loans, the money does not come “out of nothing” but out of another bank account. This is what Irving Fisher called “Man to Man” lending. He was emphatic that this did not create money, and therefore it had no significant macroeconomic effects:

A man-to-man debt may be paid without affecting the volume of outstanding currency, for whatever currency is paid by one, whether it be legal tender or deposit currency transferred by check, is received by the other, and is still outstanding. (Fisher 1932, p. 15)

Non-bank to non-bank lending is shown in Table 1. It is lending “out of something”: the lender’s deposit account is the source of the loan, and it falls by precisely as much as the borrower’s account rises.

Table 1: Non-bank lending

If the borrower later repays this debt, then as Fisher states, no money is destroyed: it is simply reallocated. This is shown in Table 2.

Table 2: Non-bank loan repayment

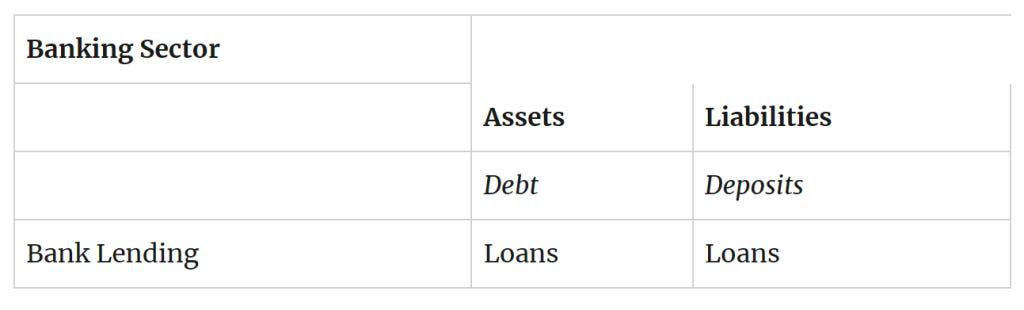

When a bank makes a loan, however, its assets and its liabilities rise simultaneously by the same amount: the loan does not come out of another account. This is what is meant by “out of nothing”: not that banks create money by magic—creating something “out of nothing”—but that money is created by bank assets and liabilities rising simultaneously. This is shown in Table 3.

Table 3: Bank Lending

Fisher was emphatic that repayment of bank loans destroys money, and therefore does have significant macroeconomic effects:

when a debt to a commercial bank is paid by check out of a deposit balance that amount of deposit currency simply disappears. (Fisher 1932, p. 15. Emphasis added)

This is shown in Table 4:

Table 4: Repaying a Bank Loan

Since this process is not “out of nothing”—like a magician pulling a rabbit out of a hat—my preferred term for bank lending is not “out of nothing”, or Selgin’s derisory term “Thin Air”, but “Bank Originated Money and Debt” (BOMD).

Selgin’s critique

Though Selgin does not use double-entry bookkeeping tables at all in his paper, he verbally accepts that the process described by Table 3 is what banks actually do when they lend—and by extension, that Table 4 describes what happens when debts are repaid.

He also makes a number of simplifying assumptions which abstract from some sources of confusion in this confusion-filled debate, and which I will also make in this response.

He abstracts from cash, and treats money as being exclusively the private sector’s deposit accounts at banks. Similarly, he treats Reserves as being exclusively the private banks’ accounts at the Central Bank, and not currency:

When a bank makes a loan, Thin Air theorists emphasize, it doesn’t hand the borrower a sack of coins, or bundles of paper money. Instead, the bank simply credits the borrower’s deposit account … by the amount of the loan. In the discussion immediately to follow, I take this for granted. Furthermore, I assume that the public doesn’t hold currency at all, but instead employs bank deposits alone in making payments. Base or high-powered money therefore consists solely of bank reserves in the form of ledger entries on a central bank’s balance sheet. (Selgin 2024, pp. 10-11)[1]

By assuming the non-existence of cash, Selgin eliminates the “Money Multiplier” explanation of money creation—which only works if all loans are in cash. By assuming that bank deposits are demand deposits—which is of course a fact—he ignores the simplistic version of Loanable Funds, in which non-bank Savers lend to non-bank Borrowers (this is the situation shown in Table 1 and Table 2). He also ignores banks borrowing from non-banks, and then on-lending these funds to other non-bank borrowers—which is what happens when banks lend from term deposits, rather than demand deposits.

These are all defensible simplifying assumptions for the case that Selgin wishes to make. They also mean that, unlike the Faure and Gersbach paper, he is actually engaging with the crux of the dispute between believers in the Loanable Funds model of bank lending, in which banks must borrow in order to lend, and supporters of the “Endogenous Money/BOMD” model, in which banks do not need to borrow when they lend.

Selgin’s objective was to prove that, though bank lending does create money, banks still need “to borrow from others” in order to lend:

Where Cannan and other economists who consider banks intermediaries differ with Thin Air theorists [is] … in denying that banks’ ability to write up loans allows them to profitably extend credit without also having to borrow from others. (Selgin 2024, p. 11)

So, who are the “others” from whom banks must borrow in order to lend, in Selgin’s analysis? It is other banks. The crux of his argument in favour of the “Loanable Funds” model of bank lending, and against what he calls the “Thin Air” model—and that I will call BOMD[2]—is that BOMD ignores the need for banks to borrow from each other via the interbank settlement system.

To make his case, he gives the example of a depositor (“Jane”) at Air Bank borrowing from it in order to buy a car from a car dealer (“Larry’s Lemons”) who banks at Other Bank. He assumes that Air Bank has no Reserves when it makes the loan. Quoting Selgin at length here, he supposes that:

Air Bank credits Jane’s account to the tune of $5,000. If Jane is like most bank borrowers, she hasn’t gone to the trouble of getting a loan for the sake of having money in the bank…

So she spends it. Let’s suppose that she buys a used Honda from Larry’s Lemons for $5,000. Were Jane try to withdraw $5,000 from the Air Bank so as to to [sic.] pay in cash, it might fail at once. But since the Thin Air theory rests upon the assumption, which I also take for granted, that bank deposits are as good as cash, we’ll suppose that Jane instead makes a mobile payment and that the Air Bank approves the transfer. Now the bank Larry’s Lemons deals with—call it the Other Bank—has a $5,000 claim against Jane’s bank, payable to Larry’s account. If its managers are feeling generous, they may allow Larry’s Lemons immediate access to the promised fund…

at the end of the business day, the Air Bank has to settle up with all the other banks out there, including Other Bank. Assuming that accounts would have balanced before Jane got her loan, this means having to come up with $5,000 in “real” (base) money, meaning (to be current) Federal Reserve dollars—money that, by hypothesis, it doesn’t have. So, either the Air Bank manages to get a last-minute loan itself, or it defaults. In other words, it finds itself in the same situation it would have been in had Jane tried to cash-out her loan. It's easy to complicate the simple story just told. But as long as banks routinely settle their interbank obligations in “real” money, as they must in any competitive banking system in which bank deposits are redeemable on demand, it isn’t easy to do so in a way that salvages the Thin Air theory (Selgin 2024, pp. 14-16).

He then castigates Jakab and Kumhof (the Bank of England staff who authored “Banks are not intermediaries of loanable funds—and why this matters” (Kumhof and Jakab 2015)) for not considering the settlement process:

Jakab and Kumhof seem to completely overlook the implications of interbank settlement. In their working paper they use the term “settlement” only once, and then only in noting that central banks supply settlement media. They never suggest that banks actually need such media, let alone explain why they need them. (Selgin 2024, p. 16)

This is the crux of Selgin’s critique of the Endogenous Money/Bank Originated Money and Debt model, and defence of Loanable Funds.

Consequences of Selgin’s critique

Leaving aside for the moment the issue of whether Selgin’s critique is successful (it isn’t), he then states some of its consequences. One of them is that the availability of Reserves constrains bank lending:[3]

In a scarce-reserve system banks can and do borrow from other banks to cover adverse clearings they cannot meet using their reserve balances. But banks have only a limited appetite for such last-minute borrowing. Once that appetite has been satisfied, they prefer to respond to reserve shortfalls by limiting their lending. (Selgin 2024, p. 20. Emphasis added)

He asserts that, though banks don’t actually lend out deposits, deposits do constrain bank lending:

the amount of lending banks can profitably engage in is constrained by the amount of the public’s real[4] savings they are able to get hold of… Although the Intermediary theory doesn’t claim that banks must have funds on hand, acquired through customer deposits or otherwise, before they can extend credit, it recognizes that primary, and especially “core” (primary retail) deposits have long been the most important source of bank funding. (Selgin 2024, pp. 25-26).

Similarly, he asserts that, though banks don’t directly lend reserves—which is the naïve idea in the Money Multiplier model— their lending is constrained by bank reserves because of the settlement process:

Here again, Jakab and Kumhof fail to appreciate the implications of routine interbank settlement. A more profound understanding reveals that, in a crucial sense, in fiat systems, commercial banks lend nothing but central bank money. (Selgin 2024, p. 31. Emphasis added)

He argues that banks and money are neutral in the long run:

there’s a fundamental sense in which banks are strictly intermediaries. It is the sense one gains by thinking in terms of real, long run or general equilibrium magnitudes. That is, by thinking of banking in the same way economists think of other industries.

That changes in the nominal quantity money are at least roughly “neutral” in the long run is perhaps the most fundamental tenet of neoclassical monetary economics. It doesn’t mean that monetary expansion never has important real short-run consequences: most obviously, it can lower unemployment when the cause of that unemployment is a lack of aggregate demand. But it doesn’t generally alter the relative size of particular industries, or of firms within them. Instead of depending on the nominal quantity of money, firms and industry’s success or failure depends on the real demand for their products…

To repeat: these conclusions are mere instances of the doctrine of long-run monetary neutrality. (Selgin 2024, pp. 41-43. Emphasis added)

Finally, he asserts that Central Banks are able to create money (Selgin 2024, pp. 31-34), and that Central Banks, rather than private banks, are responsible for periods of excessive money creation:

Indeed, the most important exceptions to the rule that ordinary banks are intermediaries arise when central banks supply them with reserves beyond their precautionary requirements. And in these exceptional cases the problem isn’t that ordinary banks can create credit out of thin air: it’s that central banks supply them with resources beyond what the public would provide them on its own. Confusing the powers of central banks with those of ordinary commercial banks makes for bad monetary and bank regulatory policies. (Selgin 2024, p. 44. Emphasis added)

I noted earlier that there was not a single double-entry bookkeeping table in Selgin’s paper—and nor is there any empirical data, or mathematics. I will use all three to show that his critique fails.

Disputing a Simplifying Assumption

Firstly, Selgin’s example of Jane borrowing from Air Bank is shown in Table 5:

Table 5: Selgin's example of Air Bank lending to Jane

The BOMD/Endogenous Money generalisation of this example to the entire banking system is shown in Table 6.

Table 6: The generalisation of Selgin's example to the BOMD view of money creation

The differential equations for this process are shown in Equation 1:

This is the crux of the Endogenous Money argument—that “Loans create Deposits”.

We can generalise this to the creation of money itself using one of Selgin’s assumptions, his abstraction from the existence of cash money.[5] Money therefore consists solely of bank deposits. This leads to the fundamental statement of the BOMD model, that “Bank Loans Create Money”. This is shown in Table 7 and Equation 2:

Table 7: The double-entry bookkeeping statement of Bank Originated Money and Debt

This is the proposition that Selgin objects to—not because he says it is wrong, but because he claims it is incomplete, since it ignores interbank lending.[6]

Selgin asserts that the undisputed need for banks to borrow from each other (or the Central Bank) in the settlement process makes a fundamental difference to the process of bank money creation. As noted earlier, he attempts to prove this by the verbal example of Air Bank lending to Jane when it has no Reserves, while Jane buys a car from Larry, who banks with Other Bank. We now need a more complicated model, with at least the two private banks, as shown in Table 8.

Table 8: Selgin's example of Air Bank customer Jane buying from Other Bank customer Larry

Selgin hammers the point that Air Bank now has negative reserves, and therefore needs to borrow them—either from the Central Bank or another Bank. This, he claims, “isn’t easy to do so in a way that salvages the Thin Air theory” (Selgin 2024, p. 16).

Selgin is right that it isn’t easy—because the whole point of simplifying assumptions is to enable a simpler model to be built, without losing the key features of the overall system. But the only way that this could sink “the Thin Air theory” would be if it changed Equation 2 in such a way that either Reserves or Deposits became an essential or limiting factor for money creation.

It doesn’t: the BOMD argument is alive and well after including interbank loans. It is just a lot more complicated, as I show in the next section. To illustrate this, I now switch from hand-written tables in Word to interlocking double-entry bookkeeping tables partly entered in and partly generated by the Open-Source system dynamics program Minsky (https://sourceforge.net/projects/minsky/).

Much Ado About Nothing

Figure 1 shows Selgin’s example in Minsky, with variables (like “LoanAir2Jane”) replacing Selgin's arithmetic example. Minsky auto-completes the entries for the Central Bank.

Figure 1: Selgin's example in Minsky

Minsky also generates the differential equations of this process, as shown in Equation 3.

As promised, it’s more complicated—because a simplifying assumption has been dropped. It also looks unsustainable, since Air Bank starts with zero reserves, and yet the rate of change of its reserves is negative. But that’s why the interbank lending market exists! I’ll now complete this picture, by including Other Bank lending the additional reserves it acquired from Jane’s debt-financed shopping spree back to Air Bank—something that happens all the time in the real world.[7] This is shown in Figure 2.

Figure 2: Selgin's example with settlement loans

The non-zero differential equations for this model are shown in Equation 4:

Does this more complicated model change the aggregate picture from Equation in any substantive way? No, not a bit. Reserves turn up in the more complicated model in Equation , but the sum effect is zero. Money now has to be defined as the sum of Deposit accounts of the non-bank private sector, but the rate of change of money is still identically equal to the rate of change of the debt of the private non-bank sector to the banks. Reserves now are part of the model, but the change in aggregate reserves is zero, and Reserves do not appear at all in the equation for money creation. A new class of loans is added to the system—interbank loans—but they too don’t affect the creation of money.

Equation 5 provides the aggregate picture, and there is no role for either Reserves or Settlement Loans, as either contributors to, or limitations on, bank money creation.

Though the situation in Selgin’s example is quite artificial—one bank initially has all the Reserves and massive net worth, the other has no Reserves and zero net worth—it would be no problem for me to build a Minsky simulation model showing that this does not affect the fundamental Endogenous Money/BOMD point that banks create money, and that neither bank reserves nor interbank lending places a limitation on this process.

I won’t do that in this post, because I don’t have the spare time to do that now—as I explain shortly. But briefly, such a model would need at least:

5 Godley Tables, rather than the 2 which suffice to model the entire banking system in one table, and the entire non-bank private sector in the other. There would be one for the Banks which made loans to customers, another for the Banks for retailers, one for the Central Bank (which can be dispensed with if I’m not modelling Reserve transactions), and one each for the borrowers and the retailiers; and

4 rates of interest, rather than one which suffices for a banking system model. In descending order of magnitude, there would be an interest rate on Bank Loans, on Interbank Loans, on Reserves, and on Deposits. If I included Treasury Bonds, there would be one more rate—higher than Reserves and less than Loans—and one more Godley Table for the Treasury.

As complicated as such a model would be, it would help address the furphy[8] I often hear about modelling banking, “if banks can create loans then why do they pay interest on deposits?”. They do so because they do need funds for interbank transactions—which are what Reserves are, as well as being the conduit from Treasury deficits to the private banking system—and getting Reserve fund via Deposits is cheaper than borrowing them on the Interbank market. They can also be used to buy Treasury Bonds, which yield a higher rate of interest and can be traded.

Though such a model would be dramatically more complicated than the usual expositional model I build of private bank money creation, the essence would remain the same: banks create money by making loans, and they do so without needing to have borrowed from either each other or the non-bank private sector to do so (which is one way to portray Deposit accounts, and is essential to the “Money Multiplier” model, which Selgin thankfully saved me from having to address via his simplifying assumption of ignoring cash).

I haven’t built such a model for this post because I am currently in Sydney to work with my programming partner Russell Standish to finalise our Ravel software for commercial release in June. Having to write this response to Selgin’s failed attempt to debunk the view that, as the Bundesbank put it, “a bank’s ability to grant loans and create money has nothing to do with whether it already has excess reserves or deposits at its disposal” (Deutsche Bundesbank 2017, p. 13),[9] was already an unwelcome distraction from that commercial effort, and I can’t afford any more time than I have already put into this long post.

I nonetheless put in this effort because, as the old saying goes, “A Lie Can Travel Halfway Around the World While the Truth Is Putting On Its Shoes”. The longer Selgin’s paper went unanswered, the more Neoclassical economists would fool themselves into believing that he had proven the Endogenous Money/BOMD view wrong.

In fact, if anything, Selgin has done the opposite: he has confirmed that the Endogenous Money/BOMD view is correct. But he didn’t see this because, like almost all Neoclassical economists, he doesn’t use double-entry bookkeeping to assess claims about the nature and creation of money (the exception is Michael Kumhof). Once you do, as I have shown here, you cannot avoid the conclusion that the Endogenous Money/BOMD view is structurally correct about how the private banking system creates money. In that sense, Selgin has done this correct exposition of banking and money creation a favour.

He didn’t realise this though, because having set up his interbank-lending riposte, he simply assumed that, once interbank lending was included in the model, money creation would be shown to depend upon the borrowing of reserves. That led to his conclusions, which are all both logically false, and easily refuted by the empirical evidence, to which I now turn.

Say What?

The funniest claim Selgin makes is that, in order to avoid interbank lending, banks refrain from lending opportunities:

In a scarce-reserve system banks can and do borrow from other banks to cover adverse clearings they cannot meet using their reserve balances. But banks have only a limited appetite for such last-minute borrowing. Once that appetite has been satisfied, they prefer to respond to reserve shortfalls by limiting their lending. (Selgin 2024, p. 20. Emphasis added)

This is laughable, even in terms of an Austrian perspective on profit-maximizing behaviour. The cost of funds in interbank lending is substantially lower than the interest rate(s) charged on commercial loans. Selgin’s argument implies that banks will turn down what they would otherwise perceive to be profitable lending opportunities if their Reserves are low.

This implies that banks and their loan officers are cautious, responsible creatures, ever afraid of being caught short. It flies in the face of historical experience, most recently of course the Subprime Lending Bubble. The only shortage that I’ve ever seen motivate the behaviour of agents in the financial system is of cocaine, not Reserves.

People with actual experience in banking—such as the successful banker turned philanthropist Richard Vague, author of The Next Economic Disaster: Why It's Coming and How to Avoid It, A Brief History of Doom: Two Hundred Years of Financial Crises and The Paradox of Debt: A new path to prosperity without crisis (Vague 2014, 2019, 2023)—will tell you that the incentives in lending are such that (until a financial crisis occurs) virtually any perceived opportunity for profitable borrowing is taken up, regardless of whether experience later shows that this was a bad idea.

Alan Holmes, then a Senior Vice President of the Federal Reserve Bank of New York, and manager of the Federal Reserve System Open Market Account, put it succinctly when he said in 1969 that:

The idea of a regular injection of reserves [as a control mechanism on bank lending] … suffers from a naive assumption that the banking system only expands loans after the System (or market factors) have put reserves in the banking system. In the real world, banks extend credit, creating deposits in the process, and look for the reserves later. (Holmes 1969, p. 73. Emphasis added)

Selgin also portrays the non-consideration of settlement lending in credit-based macroeconomic models like those built by Kumhof (Kumhof and Jakab 2015) and me (Keen 1995) as a sign that his approach to banking, and not the Endogenous Money/BOMD approach, is wise about what causes financial crises:

Some little banks have actually tried to become big banks by doing just what the Thin Air theory says banks can do. The 1772 failure of a real-world “Ayr Bank” … was managed from the start much like the fictitious “Air Bank” discussed earlier—and with similar consequences. In just three years, thanks to its generous lending policies, it became a “colossus,” accounting for 40 percent of Scottish bank assets (Rockoff 2009, 18).

But, having employed its fountain pens … so much more generously than its rivals, the Ayr was also haemorrhaging reserves… By proceeding as though the Thin Air theory were valid—that is, as if it could create credit “out of thin air”—the Ayr Bank tested that theory. And the theory failed as spectacularly as the bank itself.

The Ayr Bank case illustrates the general point that, even if it isn’t confronted with a run—that is, by depositors’ requests to withdraw “physical savings”—a bank can suffer by losing reserves to rival banks. (Selgin 2024, pp. 17-18 )

Say What? The people who have warned of such crises before they happened, and warned that financial crises are an innate property of capitalism, are almost without exception supporters of the Endogenous Money/BOMD approach, while most Neoclassicals and Austrians treat banking—and almost everything else in capitalism, apart from trade unions and governments—as forces that maintain stability rather than instability (though Austrians also rail against "fractional reserve banking"--which is another myth).

The key works on financial cycles and crises in capitalism were written by anti-Neoclassical economists, such as Joseph Schumpeter—“The Instability of Capitalism”, The theory of economic development : an inquiry into profits, capital, credit, interest and the business cycle (Schumpeter 1928; Schumpeter 1934)—the post-Great Depression Irving Fisher—“The Debt-Deflation Theory of Great Depressions” (Fisher 1933)—and Hyman Minsky—“Can "It" Happen Again?” (Minsky 1963), “Financial instability revisited: the economics of disaster” (Minsky 1972), “Capitalist Financial Processes and the Instability of Capitalism” (Minsky 1980), not by Austrian or Neoclassicals.

Dirk Bezemer’s list of those who warned of the GFC before it happened is dominated by non-mainstream economists who uses an accounting-informed framework, rather than Neoclassical concepts (Bezemer 2009, p. 9). This list included me, Wynne Godley and Michael Hudson, as well as Dean Baker and Nouriel Roubini. The only Neoclassical economist who in any sense warned of the Global Financial Crisis before it happened was Robert Shiller with Irrational exuberance (Shiller 2000, 2005).

Selgin reveals the key reason that Neoclassical economists in general not only failed to see the GFC coming, but actively supported changes in regulations that made it more severe, when he states:

That changes in the nominal quantity money are at least roughly “neutral” in the long run is perhaps the most fundamental tenet of neoclassical monetary economics. (Selgin 2024, p. 41)

Conversely, the non-neutrality of money is the most fundamental tenet of non-Neoclassical monetary economics—the tradition exemplified in the past by Schumpeter, Fisher, Minsky, Moore, Graziani (Graziani 1989), and today by me and the Post-Keynesian approach in general.

The non-neutrality of money

Schumpeter put it this way in The theory of economic development—which, though published in 1934, was his PhD thesis which he wrote in the early 1900s. Schumpeter stated that he supported “the heresy”:

that processes in terms of means of payment are not merely reflexes of processes in terms of goods. In every possible strain, with rare unanimity, even with impatience and moral and intellectual indignation, a very long line of theorists have [sic.] assured us of the opposite. (Schumpeter 1934, p. 95)

Schumpeter’s analysis of the uses to which credit money creation are put was actually flattering to the banking sector,[10] and directly contradicts Selgin’s conventional Neoclassical proposition that credit:

doesn’t generally alter the relative size of particular industries, or of firms within them. Instead of depending on the nominal quantity of money, firms and industry’s success or failure depends on the real demand for their products. (Selgin 2024, pp. 41-42)

In contrast, Schumpeter reasoned that Neoclassical general equilibrium analysis implied a world in which the rate of entrepreneurial profit was zero. With capital and labour both receiving their marginal product, the entrepreneur would have no funds left over after hiring workers and machinery to produce output. Schumpeter also assumed that an entrepreneur did not have pre-existing funds with which to pay for his innovations, and that all labour and capital was already fully employed, so that to garner workers and capital equipment, the entrepreneur would need to entice them away from existing enterprises by paying higher wages and machinery rental rates.

These are unrealistic assumptions, but they are ones which made the case Schumpeter wished to make harder to prove, rather than easier. This is how simplifying assumptions should be used (and Selgin deserves credit here—if you’ll pardon the pun!—for also using simplifying assumptions this way in his paper), in stark contrast to how Neoclassical economists frequently make assumptions that they describe as “simplifying”, but which are actually fantasies—like Faure and Gersbach’s “proof” that bank money creation doesn’t matter via the assumption that there is no uncertainty (Faure and Gersbach 2022b, p. 107).

Having made those assumptions, Schumpeter then argued that entrepreneurs can only get the money they need to turn their ideas into products by borrowing from the banking sector:

the entrepreneur—in principle and as a rule—does need credit, in the sense of a temporary transfer to him of purchasing power, in order to produce at all, to be able to carry out his new combinations, to become an entrepreneur. And this purchasing power does not flow towards him automatically, as to the producer in the circular flow, by the sale of what he produced in preceding periods… he must borrow it… He can only become an entrepreneur by previously becoming a debtor… becoming a debtor arises from the necessity of the case and is not something abnormal… He is the typical debtor in capitalist society. (Schumpeter 1934, p. 102)

Credit, in Schumpeter’s view, enables new products, or new production processes, to be introduced into the economy. It therefore transforms the production system, and without it, such transformations would either not occur, or would take much longer. Entrepreneurs who are not already capitalists would be unable to turn their innovative ideas into real products, and the real economy would be vastly different—and vastly poorer. Schumpeter therefore argues that credit does “alter the relative size of particular industries, or of firms within them”, precisely the opposite of Selgin’s conventional claim.

Selgin is, therefore, simply the latest in the “very long line of theorists” to which Schumpeter alluded who reject the claim that money has real effects. In fact, Schumpeter’s assertion that money matters is easily proven using a logical device that I call a Moore Table, in honour of the great pioneer of endogenous money research in economics, Basil Moore (Moore 1979, 1988b; Moore 2006).

A Moore Table lays out monetary expenditure and income in an economy in terms of expenditure flows between sectors or agents in the economy. Each row shows the expenditure by a given sector, and the sectors that are the recipients of that expenditure, with expenditure having a negative sign and income having a positive sign. Each column shows the net income of each sector. All entries in a Moore Table are flows of dollars per year. If every entity in an economy was included in a Moore Table, then the negative of the sum of the diagonal elements of the table would measure GDP via the expenditure method, while the sum of the off-diagonal elements would measure GDP via the income method. The two measures are necessarily equal, though in practical statistics they differ slightly thanks to measurement errors, fraud, etc.

Table 9 shows the simplest Moore Table for an economy with money but no credit or debt of any kind. Instead, there is a fixed stock of money, with each sector spending on the other two sectors. With flows labelled A to F, both aggregate expenditure and aggregate income are the sum of the flows A to F.

Table 9: A Moore Table showing expenditure IS income for a 3-sector economy

Table 10 shows the naïve form of Loanable Funds—which Selgin sensibly does not consider, since it is not compatible with bank deposits being demand deposits—in which the Services sector lending Credit dollars per year to the Household sector, and the Household sector then spends this borrowed money on the Manufacturing sector. The Household sector also has to pay Interest dollars per year to the Services sector, based on the level of outstanding debt. The transfer of money in the loan is shown across the diagonal, because only expenditure and income-generating transactions are shown across the rows.

This model has Credit reducing the expenditure that the Services sector can do (you can’t spend money that you have lent to someone else), while increasing the spending that the borrower—the Household sector—can do. This spending boosts the income of the Manufacturing sector, but it is precisely offset by the lower level of spending by the Services sector on Manufacturing (the flows A to F in this table do not have to be the same as in Table 6).

This means that the entry for Credit cancels out on both the diagonal (aggregate expenditure) and the off-diagonal (aggregate income), so that Credit is not part of aggregate expenditure or aggregate income in Loanable Funds. Therefore, if the naïve version of Loanable Funds—in which banks are strictly intermediaries for non-bank lending, and the debts are an asset of the non-bank lenders, rather than the banks—was an accurate description of what banks actually do, then Neoclassicals would be correct to ignore credit in their macroeconomics.

Table 10: The Moore Table for Loanable Funds

Table 11 shows the real-world situation of bank lending—one that Selgin supports in his critique of Endogenous Money/BOMD, but which he falsely believes still results in the extension of credit depending on (interbank) borrowing by banks.

Credit adds to both the Assets of the banking sector, and its Liabilities—the deposit accounts of the Household sector. In this simple example, Household then spend this additional money on the Manufacturing sector. The practical import of this situation is that Credit appears only once in both aggregate expenditure—the spending by the Household sector—and aggregate income—the income of the Manufacturing sector. Consequently, Credit does not cancel out, as it did for Loanable Funds, and Credit is therefore part of Aggregate Expenditure and Aggregate Income.59F[11]

Table 11: The Moore Table for Bank Originated Money and Debt

Therefore, banks, debt, credit and money must be included in macroeconomics: To leave them out is to omit the most volatile component of aggregate demand from your analysis, and the component that enables monetary and real quantities to change over time. Not understanding this is the root of the complete failure of mainstream economists to see the Global Financial Crisis coming, and in fact, to understand the business cycle itself.

Don’t confuse me with the facts

Selgin’s “Loanable Funds” claims can be juxtaposed against those of the “Endogenous Money/BOMD” camp as follows (indicative quotes from Seglin are interspersed below):

Credit should have at most transient, “short term” effects on economic activity, according to Selgin. According to the Endogenous Money/BOMD view, credit dynamics should dominate economic performance, especially during times of high private debt.

Yet there’s a fundamental sense in which banks are strictly intermediaries. It is the sense one gains by thinking in terms of real, long run or general equilibrium magnitudes. That is, by thinking of banking in the same way economists think of other industries. That changes in the nominal quantity money are at least roughly “neutral” in the long run is perhaps the most fundamental tenet of neoclassical monetary economics. It doesn’t mean that monetary expansion never has important real short-run consequences: most obviously, it can lower unemployment when the cause of that unemployment is a lack of aggregate demand. But it doesn’t generally alter the relative size of particular industries, or of firms within them. Instead of depending on the nominal quantity of money, firms and industry’s success or failure depends on the real demand for their products. (Selgin 2024, pp. 41-42)

The banking sector should evince a “natural economic limit” set by the real side of the economy: the “real” dog should wag the monetary tail. According to the Endogenous Money/BOMD view, the monetary system, unfortunately, tends to dominate the real—especially where unrestricted bank lending for asset purchases leads to “Ponzi financing”, a term invented by Hyman Minsky (Minsky 1982, p. xviii).[12]

The real size of the banking industry likewise depends on the real, and not simply the nominal, extent of the market for bank liabilities. “Given the wealth and the asset preferences of the community,” Tobin says (1963, 6-7), there is at any moment a natural economic limit to the scale of the commercial banking industry. ... Eventually the marginal returns on lending and investing, account taken of the risks and administrative costs involved, will not exceed the marginal cost to banks of attracting and holding additional deposits. (Selgin 2024, p. 42. Emphasis added)

Though banks don’t lend out Reserves (a point of view that makes Selgin somewhat of an exception to the Neoclassical norm, since the “Money Multiplier” model asserts that they do lend out Reserves), commercial bank lending will still be driven by the savings behaviour of the public and Central Bank reserve creation. According to the Endogenous Money/BOMD view, commercial bank lending will be largely independent of reserve creation (which is in fact done by the Treasury, rather than the Central Bank):

There are other situations in which commercial banks don’t behave as the Intermediary theory suggests. But none has them extending credit profitably without the help of either real public savings or central bank reserve creation. (Selgin 2024, p. 41)

That in the long run, money is merely a veil over barter. According to the Endogenous Money/BOMD view, capitalism is fundamentally a “monetary system of production”—to cite the title of Augusto Graziani’s major book (Graziani 1989, 2003).

Whatever their other shortcomings, theories that deny banks’ status as intermediaries inevitably fail to consider the long-run, equilibrium disposal of real resources, harping instead on short-run relationships or nominal magnitudes or both. That is, they look only at the veil of money, instead of looking behind it, thereby missing the fact that it is ultimately savers’ willingness to grant bankers access to real resources that allows bankers to grant their borrowers the ability to lay claim to those resources (Selgin 2024, p. 43).

That excess credit money creation is the result of excess creation of Reserves by the Central Bank. According to the Endogenous Money/BOMD view, there will be almost no relation between reserve creation and bank lending, and, if anything, the latter will drive the former:

Indeed, the most important exceptions to the rule that ordinary banks are intermediaries arise when central banks supply them with reserves beyond their precautionary requirements. And in these exceptional cases the problem isn’t that ordinary banks can create credit out of thin air: it’s that central banks supply them with resources beyond what the public would provide them on its own. Confusing the powers of central banks with those of ordinary commercial banks makes for bad monetary and bank regulatory policies. (Selgin 2024, p. 43)

It is hard to find a set of empirical claims that is more strongly rejected by the data than this collection of standard Neoclassical beliefs which Selgin espouses.

I’ll start with Selgin’s statement that “there is at any moment a natural economic limit to the scale of the commercial banking industry” (Selgin 2024, p. 42 ), allied to “banks are strictly intermediaries … thinking in terms of real, long run or general equilibrium magnitudes. That is, by thinking of banking in the same way economists think of other industries. That changes in the nominal quantity money are at least roughly “neutral” in the long run is perhaps the most fundamental tenet of neoclassical monetary economics” (Selgin 2024, p. 41).

“In the long run”. Most people are familiar with Keynes’s quip that “In the long run, we are all dead”. Few know the full statement:

But this long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. (Keynes 1929, p. 80. Emphasis added)

My riposte is somewhat less poetic: in the long run, we are still in the short run. The whole idea of a long run state to which the economy tends, and in which all the change that characterizes the short run will end, is a 19th century delusion that economics, were it truly a science, would long ago have abandoned. The one constant in capitalism is change.

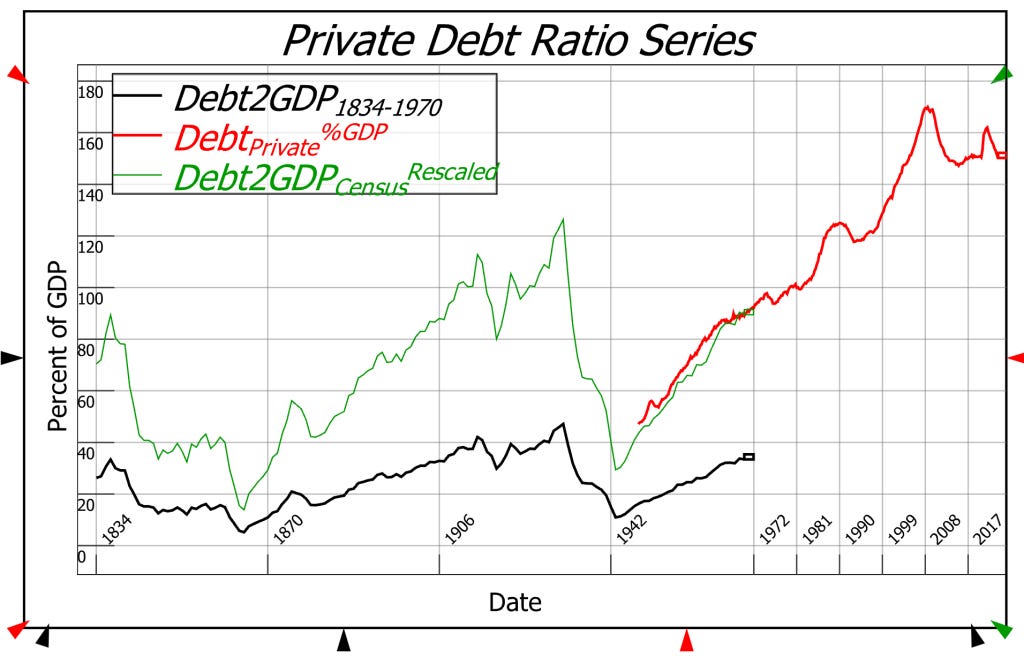

Figure 3 shows 190 years of private debt data—where do you think the “long run, equilibrium” private debt to GDP level is?

Figure 3: Can you spot the "long run, general equilibrium" ratio of private debt to GDP? Me neither

Focusing just on the post-WWII period, rather than having merely transient impacts upon the level of economic activity, credit—the annual change in the level of private debt—is the primary factor driving the level of economic activity. Especially during times of high private debt—and we are in such a time now, thanks in large part to Neoclassical economists, who dominate policy bodies as well as academic economics, ignoring the growth of private debt—the ups and downs of the economy are the mirror image of the downs and ups of credit. When credit rises, unemployment falls; when credit falls, unemployment rises. There is nothing sustainable about this process—its cyclicality led to the accumulation of private debt to a point at which the real economy couldn’t finance the debt and we had a financial crisis. But this is precisely what the conventional Loanable Funds/Money Multiplier models ignore, which is why Neoclassical economists had no idea that a collapse was imminent in the early 2000s.

Figure 4: Private Debt, Credit, and Unemployment

The correlation between credit and unemployment is significant and in the direction expected by the BOMD theory—a negative correlation, when credit rises, unemployment falls, and vice versa—over the whole time period for the FRED unemployment data series (from 1980 till 2023): see Figure 5. It is “off the scale” (at minis 0.93!) for the period of rising and extremely high private debt, and then falling and still extremely high private debt, between 1990 and 2015.

Figure 5: Correlation of Credit to Unemployment

Rather than change in reserves driving bank lending, as Selgin surmises, there is virtually no relationship between credit and reserve creation for the whole post-WWII period, until the financial crisis, after which reserve “creation” (actually, Central Bank conversion of outstanding government bonds into reserves via “Quantitative Easing”) explodes, leading to a negative correlation (minus 0.54) between reserve change and credit—which is the opposite sign to that implied by Selgin’s analysis: see Figure 6.

Figure 6: The relationship between Reserves, and changes in Reserves, and Credit

Selgin’s argument that “the problem isn’t that ordinary banks can create credit out of thin air: it’s that central banks supply them with resources beyond what the public would provide them on its own” (Selgin 2024, p. 44) implies the growth in reserves would cause a (transient) fall in unemployment, as more reserves enabled more credit and caused a short-term boom in economic activity. There should therefore be a negative correlation between change in reserves and unemployment.

Instead, for most of the post-WWII period, there is no relationship—that’s the heavy concentration of dots in Figure 7, where unemployment rises and falls while change in Reserves is virtually zero—and then the huge Neoclassical-policy-driven period of rapdily rising reserves under QE has a positive correlation with unemployment (note also that the change in ReservesßàUnemployment correlation plot in Figure 7 is virtually the inverse of the change in ReservesßàCredit plot—in Figure 6, since credit is overwhelmingly the major determinant of unemployment, while Reserves and Credit are virtually unrelated).

Figure 7: The relationship between change in Reserves and Unemployment

Will Neoclassicals ever abandon Loanable Funds?

The double-entry bookkeeping, the mathematical logic, and the empirical data, show overwhelmingly that banks, private debt, and credit, and money, matter to macroeconomics. But I’ve been making these points for four decades now, without causing economics to shift an iota—though in the meantime, MMT has been developed by other non-mainstream economists, and at least that has somewhat shifted the public debate on money (Kelton 2020).

I don’t expect this situation to change: false models of money, in which credit money is macroeconomically insignificant, will continue to be taught by Neoclassical and Austrian economists, because to do otherwise would be to cause their paradigms to unravel.

That, in the end, is why Neoclassicals either ignore the Endogenous Money/BOMD theory of money, or wrongly reject it, as Selgin does in his paper. Fundamentally, this is because, as Max Planck lamented in his autobiography, it is almost impossible to get a believer in an old paradigm to convert to a new one via logical argument alone:

It is one of the most painful experiences of my entire scientific life that I have but seldom—in fact, I might say, never—succeeded in gaining universal recognition for a new result, the truth of which I could demonstrate by a conclusive, albeit only theoretical proof. (Planck 1949, p. 21)

The creation of money by banks (largely independently of the creation of Reserves by the Treasury, or the manipulation of interest rates by the Central Bank), the real impact of these monetary transactions, and their role in the manifest instability and evolutionary dynamism of capitalism, are contrary to the fundamentally barter-based, equilibrium view of capitalism that is the foundation of Neoclassical economics. The only way that a Neoclassical economist can accept the endogenous creation of money by banks, and the vital role that monetary dynamics play in capitalism, is by ceasing to be a Neoclassical economist.

That is just too hard for most of them, as it was for most physicists in Planck’s day. Some do—which is how many non-Neoclassical economists come about (my friend Dirk Ehnts is one such exception). But the majority stare into the abyss this implies for them—their defining beliefs, which they hold as strongly as does any religious person, are false; the community, from which they will be shunned; the social and political status, which they would in all likelihood lose—and turn away from the new way of thinking.

This isn’t an insurmountable problem in physics, because the theoretical anomalies that give rise to new paradigms are permanent fixtures of reality. These ultimately lead to new students embracing the new paradigm when they come to replace their professors as they age and eventually die:

A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it. (Planck 1949, p. 23)

But it is insurmountable in economics, because its anomalies are transient, and sufficient stalwart believers in the old Neoclassical religion can be found in every generation of students to replace their predecessors. Therefore, the delusions live on, despite the overwhelming evidence against them.

This is why my preferred term for the mainstream in economics is not “Neoclassical economics”—which was originally Veblen’s term of derision for them—but “Ptolemaic Economics”, which is both more derisive and more accurate.

Like Galileo’s Earth-centric predecessors, they have an equilibrium-oriented vision of their system (of the economy rather than the Universe), it is based on the “great books” by their founders (Walras and Marshall, rather than Aristotle and Ptolemy) rather than empirical analysis, they hang onto their belief system despite evidence to the contrary, and they steadfastly refuse to use the new tools that the rival, correct paradigm has developed to properly understand the system they pretend to comprehend through models which can, when well tweaked, fit the data most of the time, but which are completely wrong as an explanation of the structure of the economy.

Ravel

Though this work was a distraction from working with my programmer-partner Russell Standish to finalise our Ravel software for commercial release, it is also a showcase of Ravel. All the plots in this paper were done using Ravel, and the work to create them was far easier than it would have been in a spreadsheet program like Excel.

We will shortly be releasing Ravel commercially via Patreon. Please keep an eye out for its launch, and consider signing up to both get a copy and to support its further development. We will price it at 10 Australian dollars a month, which is roughly US$6.50. This is 2/3rds the price of Microsoft’s Power BI, and though not as slick, Ravel is far more powerful than Power BI, and all other “Business Intelligence” programs, and far easier to drive. Our ambition is to take over the Business Intelligence market, and also compete with spreadsheets since Ravel is much easier to audit than spreadsheets are, with English-language equations expressed in flowcharts where one formula can take the place of thousands of Excel cell-reference formulas. Figure 8 shows the file that created all the empirical figures in this post.

Figure 8: The Ravel file with all the data importing, equations and graphics for this article

It won’t be easy to break into the spreadsheet/BI marketplace with our limited marketing budget (zero $), but one great advantage of the capitalist marketplace is that it’s far easier to overturn an old paradigm than it is in Economics.

References

Bezemer, Dirk J. 2009. "“No One Saw This Coming”: Understanding Financial Crisis Through Accounting Models." In. Groningen, The Netherlands: Faculty of Economics University of Groningen.

Chick, Victoria, and Sheila Dow. 2002. 'Monetary Policy with Endogenous Money and Liquidity Preference: A Nondualistic Treatment', Journal of Post Keynesian Economics, 24: 587-607.

Deutsche Bundesbank. 2017. 'The role of banks, non- banks and the central bank in the money creation process', Deutsche Bundesbank Monthly Report, April 2017: 13-33.

Dow, Sheila C. 1997. 'Endogenous Money.' in G. C. Harcourt and P.A. Riach (eds.), A "second edition" of The general theory (Routledge: London).

Faure, Salomon, and Hans Gersbach. 2022a. 'Loanable funds versus money creation in banking: a benchmark result', Journal of Economics, 135: 107-49.

———. 2022b. 'Loanable funds versus money creation in banking: a benchmark result', Journal of economics (Vienna, Austria), 135: 107-49.

Fiebiger, Brett. 2014. 'Bank credit, financial intermediation and the distribution of national income all matter to macroeconomics', Review of Keynesian Economics, 2: 292-311.

Fisher, Irving. 1932. Booms and Depressions: Some First Principles (Adelphi: New York).

———. 1933. 'The Debt-Deflation Theory of Great Depressions', Econometrica, 1: 337-57.

Fullwiler, Scott T. 2013. 'An endogenous money perspective on the post-crisis monetary policy debate', Review of Keynesian Economics, 1: 171–94.

Godley, Wynne. 2004. 'Money and Credit in a Keynesian Model of Income Determination: Corrigenda', Cambridge Journal of Economics, 28: 469-69.

Graziani, Augusto. 1989. 'The Theory of the Monetary Circuit', Thames Papers in Political Economy, Spring: 1-26.

———. 2003. The monetary theory of production (Cambridge University Press: Cambridge, UK).

Holmes, Alan R. 1969. "Operational Constraints on the Stabilization of Money Supply Growth." In Controlling Monetary Aggregates, edited by Frank E. Morris, 65-77. Nantucket Island: The Federal Reserve Bank of Boston.

Jarsulic, M. 1989. 'Endogenous credit and endogenous business cycles', Journal of Post Keynesian Economics, 12: 35-48.

Keen, Steve. 1995. 'Finance and Economic Breakdown: Modeling Minsky's 'Financial Instability Hypothesis.'', Journal of Post Keynesian Economics, 17: 607-35.

———. 2014. 'Endogenous money and effective demand', Review of Keynesian Economics, 2: 271–91.

———. 2015. 'The Macroeconomics of Endogenous Money: Response to Fiebiger, Palley & Lavoie', Review of Keynesian Economics, 3: 602 - 11.

Kelton, Stephanie. 2020. The Deficit Myth: Modern Monetary Theory and the Birth of the People's Economy (PublicAffairs: New York).

Keynes, J. M. 1929. A Tract on Monetary Reform (Macmillan: London).

Kumhof, Michael, and Zoltan Jakab. 2015. "Banks are not intermediaries of loanable funds — and why this matters." In Working Paper. London: Bank of England.

Lavoie, Marc. 2014. 'A comment on ‘Endogenous money and effective demand’: a revolution or a step backwards?', Review of Keynesian Economics, 2: 321 - 32.

McLeay, Michael, Amar Radia, and Ryland Thomas. 2014. 'Money creation in the modern economy', Bank of England Quarterly Bulletin, 2014 Q1: 14-27.

Minsky, Hyman P. 1963. 'Can "It" Happen Again?' in Dean Carson (ed.), Banking and Monetary Studies (Richard D. Irwin: Homewood, Illinois).

———. 1972. 'Financial instability revisited: the economics of disaster.' in Board of Governors of the Federal Reserve System (ed.), Reappraisal of the Federal Reserve Discount Mechanism (Board of Governors of the Federal Reserve System: Washington, D.C.).

———. 1975. John Maynard Keynes (Columbia University Press: New York).

———. 1977. 'Banking and a Fragile Financial Environment', Journal of Portfolio Management, 3: 16-22.

———. 1980. 'Capitalist Financial Processes and the Instability of Capitalism', Journal of Economic Issues, 14: 505-23.

———. 1982. Can "it" happen again? : essays on instability and finance (M.E. Sharpe: Armonk, N.Y.).

Minsky, Hyman P., Edward J. Nell, and Willi Semmler. 1991. 'The Endogeneity of Money.' in, Nicholas Kaldor and mainstream economics: Confrontation or convergence? (St. Martin's Press: New York).

Minsky, Hyman P., Arthur M. Okun, and Clark Warburton. 1963. 'Comments on Friedman's and Schwartz' Money and the Business Cycles', The Review of Economics and Statistics, 45: 64-78.

Moore, Basil J. 1979. 'The Endogenous Money Supply', Journal of Post Keynesian Economics, 2: 49-70.

———. 1988a. 'The Endogenous Money Supply', Journal of Post Keynesian Economics, 10: 372-85.

———. 1988b. Horizontalists and Verticalists: The Macroeconomics of Credit Money (Cambridge University Press: Cambridge).

———. 1997. 'Reconciliation of the Supply and Demand for Endogenous Money', Journal of Post Keynesian Economics, 19: 423-28.

Moore, Basil John. 2006. Shaking the Invisible Hand: Complexity, Endogenous Money and Exogenous Interest Rates (Houndmills, U.K. and New York: Palgrave Macmillan).

Palley, Thomas. 2013. 'Horizontalists, verticalists, and structuralists: the theory of endogenous money reassessed', Review of Keynesian Economics, 1: 406–24.

———. 2014. 'Aggregate demand, endogenous money, and debt: a Keynesian critique of Keen and an alternative theoretical framework', Review of Keynesian Economics, 2: 312--20.

Palley, Thomas I. 1991. 'The Endogenous Money Supply: Consensus and Disagreement', Journal of Post Keynesian Economics, 13: 397-403.

Planck, Max. 1949. Scientific Autobiography and Other Papers (Philosophical Library; Williams & Norgate: London).

Schumpeter, Joseph. 1928. 'The Instability of Capitalism', The Economic Journal, 38: 361-86.

Schumpeter, Joseph Alois. 1934. The theory of economic development : an inquiry into profits, capital, credit, interest and the business cycle (Harvard University Press: Cambridge, Massachusetts).

Selgin, George. 2024. "Banks Are Intermediaries of Loanable Funds." In CATO WORKING PAPER. CATO Institute.

Shiller, Robert J. 2000. Irrational exuberance (Princeton University Press: Princeton, N.J.).

———. 2005. Irrational exuberance (Broadway Books: Princeton, N.J.).

Vague, Richard. 2014. The Next Economic Disaster: Why It's Coming and How to Avoid It (University of Pennsylvania Press: Pennsylvania).

———. 2019. A Brief History of Doom: Two Hundred Years of Financial Crises (University of Pennsylvania Press: Philadelphia).

———. 2023. The Paradox of Debt: A new path to prosperity without crisis (Forum: London).

Notes

[1] He also assumes that the quantity of Reserves is fixed: “I will also assume, for the time being, that the total quantity of such reserves is fixed. It follows from this that banks alone are able to add too [sic.] or subtract from the sum total of bank deposits, through changes in their lending activity. However, as I hope to show, it does not follow that the public’s willingness to accumulate real bank deposits isn’t a crucial determinant of the volume of bank lending.” (Selgin 2024, p. 11)

[2]The term used in the literature is “Endogenous Money” (Moore 1988a; Minsky, Nell, and Semmler 1991; Palley 1991; Moore 1997; Chick and Dow 2002; Palley 2013)

[3] He considers both the scarce Reserves system we lived in prior to the Great Recession, and the abundant Reserves system we have lived in since. He reaches the same conclusion in both cases.

[4] Selgin uses “real” to refer to money created by the Central Bank—see the phrase cited earlier: ‘“real” (base) money, meaning (to be current) Federal Reserve dollars’ (Selgin 2024, p. 15).

[5] “I assume that the public doesn’t hold currency at all, but instead employs bank deposits alone in making payments.” (Selgin 2024, p. 11)

[6] He also asserts that including interbank lending will show that lending is constrained by what he frequently calls “real” money, and by which he means Bank Reserves, which he thinks (wrongly, as I’ll show later) are created by the Central Bank.

[7] As I told George via Twitter (https://x.com/ProfSteveKeen/status/1779949519695978975), my father (Alby Keen) was, amongst other roles in his working life, a Settlements Officer for Australia’s Commonwealth Bank, and back in the days when settlements were done with physical cheques too, rather than electronic transfers.

[8] That’s Australian slang for a widely believed but false story.

[9] “It suffices to look at the creation of (book) money as a set of straightforward accounting entries to grasp that money and credit are created as the result of complex interactions between banks, non- banks and the central bank. And a bank’s ability to grant loans and create money has nothing to do with whether it already has excess reserves or deposits at its disposal.” (Deutsche Bundesbank 2017, p. 13)

[10] He didn’t consider bank lending financing asset price bubbles in what his student Hyman Minsky called “Ponzi Finance”, and he also ignored the accumulation of debt by a series of credit-financed booms and busts that Minsky called the “Financial Instability Hypothesis”.

[11] I thank Tom Palley, Marc Lavoie and Brett Fiebiger for feedback in the debate where I finally worked this logic out correctly, and LP Rochon, the journal’s editor, for arranging the debate (Fiebiger 2014; Lavoie 2014; Palley 2014; Keen 2014, 2015).

[12] “Much investment activity depends on financing relations in which total short-term debt outstanding increases because the interest that is due on earlier borrowings exceeds the income earned by assets. I call this "Ponzi financing." Rapidly rising and high interest rates increase Ponzi like financing activity. A rapid run-up of such financing almost guarantees that a financial crisis will emerge or that concessionary refinancing will be necessary to hold off a crisis.” (Minsky 1982, p. xviii )

Steve, I’d like to mention/emphasize a few points:

- Moore tables (9, 10, 11) which are missing here can be found in your book Funny Money (https://www.stevekeenfree.com/free-book);

- How vital is double-entry bookkeeping and how nicely have you shown that “Selgin has done the opposite: he has confirmed that the Endogenous Money/BOMD view is correct.”

- The phrase “in the long run, we are still in the short run” is brilliant!

Also, good luck with Ravel’s release.

You are correct in your analysis in every way...except you do not acknowledge that:

1) the deeper problem is the current monopolistic paradigm for the creation and distribution of new money AKA Debt Only and

2) that the solution to that problem is strategically integrating the new paradigm of Direct and Reciprocal Monetary Gifting into the economy via the same double entry bookkeeping device that the banks currently utilize to create new money ONLY AS DEBT.

Lets get beyond correct and excellent yet mere theorizing, and ACT to implement the new monetary paradigm.