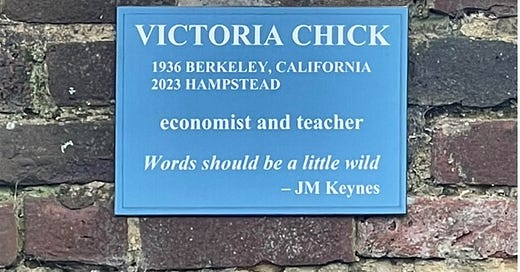

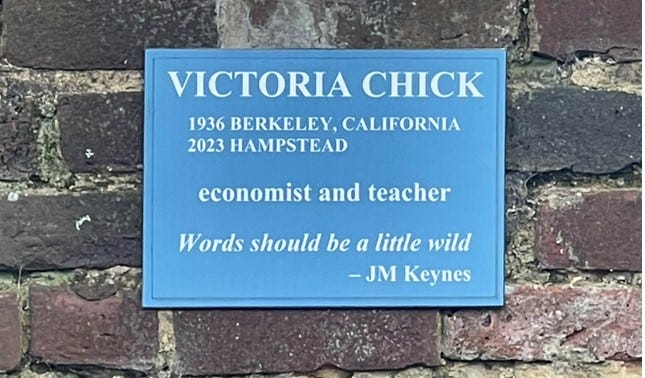

The Post-Keynesian Economist Victoria Chick—Vicki to her friends—died earlier this year, and was celebrated today by the interment of her ashes in her beloved home of Hamstead, and a tribute to her at University College London, her academic home for over half a century.

With Vicki's death, most of her generation—who were prominent critics of conventional economics in the 1960s and 1970s—is no more. I've attended several funerals now for scholars like Vicki, who opposed the Neoclassical mainstream in economics, only to see that mainstream outlive them.

Though it's both hard and weird to acknowledge it, I'm now one of today's elders of non-mainstream economics. I cracked 70 last month, friends like Marc Lavoie are close behind, and we're watching a new generation of rebels take our place. The thought that made Vicki's farewell both poignant and chilling for me was, will the Neoclassical mainstream of economics still be dominant when my day of internment arrives?

Unfortunately, I believe so. The fact that Neoclassical economics is still dominant today, when it has been empirically and logically contradicted for over a century, proves that Max Planck's adage that "Science advances one funeral at a time" does not apply to economics.

If funerals alone could have killed it, it would have died in the decades after the Great Depression—the economic event which, more than any other, showed that there was something seriously wrong with the mainstream vision of capitalism as a self-adjusting system that, left to its own devices, will achieve a state of welfare-maximizing equilibrium.

Instead, Neoclassicals developed a twisted tale in which the Great Depression was caused, not by capitalism itself, but by the government. Specifically, they blamed the Federal Reserve for tightening monetary policy. Milton Friedman was the first to make this case, arguing, as Ben Bernanke put it, that:

Federal Reserve policy turned contractionary in 1928, in an attempt to curb stock market speculation… the main lines of causation [of the Great Depression] ran from monetary contraction—the result of poor policy-making and continuing crisis in the banking system—to declining prices and output. (Bernanke 2000)

Bernanke echoed this explanation in an obsequious speech he made at Milton Friedman's 90th birthday function in 2002:

Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna: Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again.

Bollocks. The real cause of the Great Depression was the collapse of a private debt bubble that the economics mainstream completely ignored. The Roaring Twenties roared because of a private-debt-fuelled Ponzi scheme that began in real estate and ended up in the Stock Market. The party came to an end when credit flipped from almost 10% of GDP in 1928 to almost minus 10% in 1933—see Figure 1.

Figure 1: Credit collapsing from almost 10% of GDP to almost minus 10% is what caused The Great Depression

With their fallacious argument that bad monetary policy caused the Great Depression, this particular anomaly—from the point of view of mainstream economics—was dealt with. To this day, even after the "Great Recession" gave us a repeat performance (see Figure 2) the mainstream still hasn't considered the argument that the private banking system, and not the Federal Reserve, caused the Great Depression.

Figure 2: Credit collapsing from over 15% of GDP to almost minus 5% is what caused The Great Recession

All other anomalies have been treated the same way: either ignored, or explained away by an alternative scapegoat that doesn't challenge the mainstream view of capitalism as a self-regulating system.

This isn't done because Neoclassical economists are paid shrills or apologists for capitalism, but because the Neoclassical model describes a utopia and, for whatever reason, humans seem to yearn for utopias. The Neoclassical model is a utopia because it asserts that people earn what they deserve—their "marginal product"—while also getting what they want from the system—they "maximize their utility" subject to their budget constraints. Even when the real world departs wildly from this textbook vision, the desire to believe overwhelms the desire to understand.

Funnily enough, this isn't all that far removed from how actual scientists behave, as Max Planck—the discoverer of quantum mechanics—himself lamented. He remarked in his autobiography that:

It is one of the most painful experiences of my entire scientific life that I have but seldom—in fact, I might say, never—succeeded in gaining universal recognition for a new result, the truth of which I could demonstrate by a conclusive, albeit only theoretical proof. (Planck 1949, p. 22)

The difference between science and economics comes down, not to the behaviour of people, but to the nature of the anomalies that disturb the existing paradigm. Planck overturned 19th century physics with the discovery that the only way to explain the radiation emitted by a "black body" was to accept that energy was not continuous, as in Maxwell's theory, but that it came in discrete packets he called "quanta".

Though Planck was correct, science made the move from Maxwellian physics to quantum mechanics, not because physicists were better people than economists (though in the main, they are), but because scientific anomalies don't go away, whereas economic ones do.

Planck's contemporaries continued to teach Maxwell's theories and resist Planck's paradigm. As time went on, these Maxwellian professors ultimately retired or died, and had to be replaced—and their replacements were students who were wedded, not to the old failed Maxwellian paradigm, but to the new paradigm of quantum mechanics. As Planck put it:

A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it. (Planck 1949, pp. 23-4)

Scientific revolutions occur in sciences because the anomaly that undermines the dominant theory doesn't go away. But in economics, the anomaly passes with time: no student can reproduce the Great Depression and then check whether the mainstream rationalization or a radical new explanation makes more sense of the event.

A minority of students can't accept the old way of thinking—which is where rebels like Vicki, and myself, and today's members of Rethinking Economics come from. But another minority also exists that finds the libertarian message of the Neoclassical mainstream seductive, and it is they—rather than the rebels—who form the next generation of Professors.

So Neoclassical economics has outlived Veblen, and Sraffa, and Keynes, and now Chick and Harcourt. Someday in the future, it will outlive me, and Kelton, and Lavoie.

The only alternative I can see is far less pleasant: that rather than Neoclassical economics outliving its critics, it may in fact kill capitalism first.

Farewell then Vicky. I'm no believer in the afterlife, but if there is one, I'm sure you're discussing your works and downing a pint now with your fellow departed economic rebels (Chick 1991, 1997; Chick 1998; Krugman et al. 1998; Chick 2001; Chick and Dow 2001; Chick and Dow 2002, 2005; Chick 2008; Chick and Dow 2012; Chick and Tily 2014).

References

Bernanke, Ben S. 2000. Essays on the Great Depression (Princeton University Press: Princeton).

Chick, V. 1991. 'Hicks and Keynes on liquidity preference: a methodological approach', Review of Political Economy, 3: 309-19.

———. 1997. 'Some reflections on financial fragility in banking and finance', Journal of Economic Issues , 31 (2) pp. 535-541. (1997).

Chick, Victoria. 1998. 'On Knowing One's Place: the Role of Formalism in Economics', The Economic journal (London), 108: 1859-69.

———. 2001. 'Cassandra as optimist.' in Riccardo Bellofiore and Piero Ferri (eds.), Financial Keynesianism And Market Instability: The Economic Legacy of Hyman Minsky (Edward Elgar Publishing: Cheltenham).

———. 2008. 'Could the crisis at Northern Rock have been predicted?: An evolutionary approach', Contributions to political economy, 27: 115-24.

Chick, Victoria, and Sheila Dow. 2002. 'Monetary Policy with Endogenous Money and Liquidity Preference: A Nondualistic Treatment', Journal of Post Keynesian Economics, 24: 587-607.

———. 2005. 'The Meaning of Open Systems', Journal of Economic Methodology, 12: 363-81.

Chick, Victoria, and Sheila C. Dow. 2001. 'Formalism, logic and reality: a Keynesian analysis', Cambridge Journal of Economics, 25: 705-21.

———. 2012. 'On causes and outcomes of the European crisis: Ideas, institutions, and reality', Contributions to political economy, 31: 51-66.

Chick, Victoria, and Geoff Tily. 2014. 'Whatever happened to Keynes's monetary theory?', Cambridge Journal of Economics, 38: 681-99.

Krugman, P., E. R. Weintraub, R. E. Backhouse, and V. Chick. 1998. 'Formalism in economics', The Economic journal (London), 108: 1829-69.

Planck, Max. 1949. Scientific Autobiography and Other Papers (Philosophical Library; Williams & Norgate: London).

You could also include: 'The Economic Consequences of Mr Osborne – updated',

by Dr. Geoff Tily, Professor Victoria Chick and Ann Pettifor - https://primeeconomics.org/articles/the-economic-conseques/

"This isn't done because Neoclassical economists are paid shrills or apologists for capitalism". Really Steve?

I have long believed that it is so intuitively obvious- even to the layman- that economic crises are caused by debt sucking the juice out of the economy of real goods and services that there is no other explanation for the behaviour of mainstream economists. 90% spin-doctor, 10% bad scholarship.